In a dynamic trucking industry, navigating complex truck repair insurance requirements is crucial for compliance. Firms must tailor policies based on cargo types, operational conditions, and specific risks, covering mechanical repairs, towing, liability, and contingency plans. Regular audits, gap analysis, standardized claim management, training, and continuous improvement ensure full fleet coverage, risk mitigation, and operational efficiency, addressing truck repair insurance as a key component of overall compliance.

Ensuring fleet-wide compliance with coverage requirements is paramount for businesses relying on trucks. This comprehensive guide delves into the essential aspects of managing risk, specifically focusing on truck repair insurance needs across diverse industries. From understanding evolving regulations to identifying coverage gaps, we provide actionable strategies for implementing robust fleet-wide compliance. Learn how regular audits and continuous improvement can safeguard your operation in the long term, ensuring your trucks remain on the road and your business thrives.

Understanding Truck Repair Insurance Requirements Across Industries

In the dynamic landscape of trucking, understanding and adhering to truck repair insurance requirements is paramount for businesses aiming for fleet-wide compliance. These regulations vary significantly across industries, reflecting the diverse nature of cargo transported and operational conditions faced. For instance, companies hauling hazardous materials are subject to stringent protocols, including specialized coverage for accidents involving such substances. Conversely, those engaged in local deliveries may require policies that prioritize quick turnaround times for repairs, ensuring minimal disruption to daily operations.

Knowing these variations is crucial for selecting the right truck repair insurance policy. Coverage options include not just mechanical and bodily damage repairs but also towing services, liability protection against third-party claims, and even contingency plans for unexpected maintenance needs. By tailoring their insurance to specific industry needs, trucking companies can mitigate risks, safeguard assets, and maintain operational efficiency across their entire fleet.

Assessing Your Fleet's Coverage Gaps and Risks

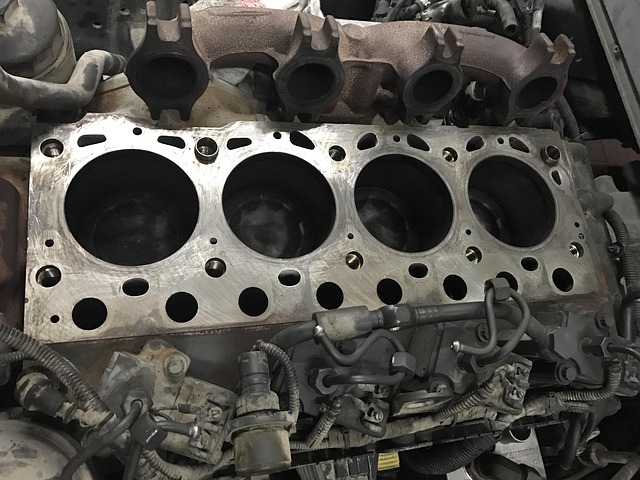

Assessing your fleet’s coverage gaps is a critical step in ensuring fleet-wide compliance with truck repair insurance requirements. Begin by thoroughly reviewing each vehicle’s existing insurance policy, paying close attention to deductibles, coverage limits, and specific exclusions. Compare these details against industry standards and regulatory mandates to identify any shortcomings or discrepancies. This process helps uncover potential risks that may leave your fleet vulnerable during unexpected repairs or mechanical failures.

Consider the nature of your trucking operations when evaluating coverage gaps. High-risk routes, heavy cargo loads, or frequent stop-and-go traffic can increase the likelihood of accidents and subsequent repair needs. By understanding these risk factors, you can tailor your insurance policies to cover specific scenarios, ensuring comprehensive truck repair insurance across your entire fleet.

Strategies for Implementing Comprehensive Fleet-Wide Compliance

Ensuring fleet-wide compliance with coverage requirements is no simple task, but it’s crucial for avoiding costly penalties and maintaining operational efficiency. A comprehensive strategy involves several key strategies. First, conduct a thorough audit of your current insurance policies to identify gaps in coverage. This includes specific scrutiny of truck repair insurance, ensuring that all vehicles are adequately covered for unexpected maintenance or repairs.

Next, implement standardized procedures for documenting and managing claims. Streamlining this process enhances accountability and ensures that every vehicle receives the necessary support when repairs are required. Regular training sessions for your fleet managers and drivers on compliance guidelines and policy updates are also essential. By fostering a culture of adherence to regulations, you can minimize errors and ensure consistent compliance across your entire fleet.

Regular Audits and Continuous Improvement for Long-Term Success

Regular, comprehensive audits are an indispensable tool for maintaining fleet compliance with coverage requirements over the long term. By meticulously scrutinizing every aspect of a company’s operations, from vehicle maintenance records to driver qualifications and insurance policies like truck repair insurance, these audits identify potential gaps or weaknesses in adherence. This proactive approach allows businesses to rectify issues promptly, minimizing risks associated with non-compliance.

Continuous improvement is intrinsically linked to successful compliance management. After each audit, fleet managers should analyze the findings, implement necessary changes, and set new benchmarks for excellence. Staying agile and responsive to evolving industry standards ensures that the fleet remains not just compliant but also ahead of the curve in terms of safety, efficiency, and cost-effectiveness. This iterative process fosters a culture of accountability and enhances overall operational resilience.

Ensuring fleet-wide compliance with truck repair insurance requirements is a multifaceted process that demands a deep understanding of industry-specific mandates. By meticulously assessing coverage gaps and risks, implementing robust strategies for fleet-wide adherence, and fostering a culture of regular audits and continuous improvement, businesses can navigate the complexities of these regulations effectively. Embracing these practices not only guarantees compliance but also fosters operational efficiency and financial resilience in the dynamic landscape of trucking.