Owner-operators bear direct liability for operational damages, making physical damage policies essential for risk management. These policies cover repairs or replacements after incidents but do not primary address immediate losses like bodily injuries or driver negligence. Understanding the scope and limitations of these policies is critical to mitigating financial risks associated with accidents and legal complexities. By adhering to liability requirements, owner-operators can safeguard their assets and ensure stability even in unforeseen events.

Understanding primary liability requirements is crucial for owner-operators navigating the complexities of their legal and financial obligations. This article delves into the core concept of primary liability, its relevance for owner-operators, and how it intersects with essential components like physical damage policies. By exploring common exclusions in these policies and industry-specific regulations, we equip operators with knowledge to mitigate risks effectively. Learn best practices for risk management and discover strategies to enhance coverage beyond physical damage policies, ensuring peace of mind and operational integrity.

Definition of Primary Liability and Its Relevance for Owner-Operators

Primary liability, a cornerstone of insurance law, refers to the direct and immediate responsibility for damages caused by one’s actions or operations. For owner-operators, understanding this concept is paramount due to their unique position in the business landscape. As individuals who both own and operate their vehicles or equipment, they bear a significant risk of physical damage and liability claims. This is where physical damage policies step in as a crucial safety net.

These policies are designed to cover the costs associated with repairing or replacing property damaged by the owner-operator’s activities. By ensuring that such policies are adequate and up-to-date, owner-operators can mitigate their primary liability risks. Understanding the scope and limitations of these policies is essential for effective risk management, enabling them to navigate the legal and financial complexities that may arise from accidents or incidents involving their operations.

– Understanding primary liability: A basic concept

Primary liability is a fundamental concept in insurance and risk management, particularly for owner-operators. It refers to the direct responsibility or obligation that an individual or entity bears for their actions or operations. In the context of owner-operators, this means understanding the legal and financial consequences of any harm or damage caused by their business activities. One key aspect is recognizing the distinction between primary liability and other forms of insurance, such as physical damage policies, which often provide secondary coverage.

Owner-operators must grasp that primary liability covers immediate and direct losses resulting from their operations. For instance, if an accident occurs due to a driver’s negligence while operating a vehicle, the owner-operator could be held liable for any bodily injuries or property damages caused. Physical damage policies, on the other hand, typically step in to cover repairs or replacements after an incident, offering financial protection above and beyond the primary liability coverage. Understanding this distinction is crucial for effective risk management and ensuring adequate insurance protection for their business operations.

– Why owner-operators need to be aware of this

Owner-operators, whether running a small fleet or independent contractors, must be vigilant about their primary liability requirements to avoid significant financial risks and ensure smooth operations. Understanding and adhering to these regulations is crucial as it protects them from potential claims and losses associated with accidents or damages caused during business activities.

One of the key aspects involves physical damage policies. These policies play a vital role in mitigating risks by providing coverage for any direct physical harm or destruction caused to property, which is essential given that owner-operators often manage vehicles and equipment. By being cognizant of their liability obligations, they can safeguard their assets, minimize legal liabilities, and maintain financial stability in the event of unforeseen incidents.

Physical Damage Policies: What They Cover and Their Limitations

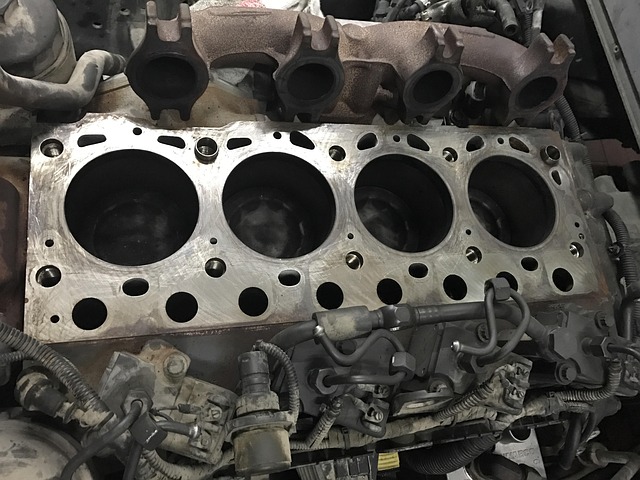

Owner-operators need to understand that Physical Damage Policies are designed to cover losses related to tangible, physical damages to vehicles and other property. These policies typically include coverage for accidents, natural disasters, and vandalism, ensuring that owner-operators are protected against financial losses due to physical damage. However, there are limitations to what these policies cover. For instance, physical damage policies generally exclude wear and tear, regular maintenance, and mechanical failures that do not result from external events or accidents.

It’s crucial for owner-operators to recognize that these policies may not cover all types of damages. For example, if a vehicle is damaged due to poor road conditions or operator error, the physical damage policy might not provide compensation. Additionally, some policies have deductibles and exclusions related to specific perils like floods, earthquakes, or war, which owner-operators should carefully review before purchasing coverage. Understanding these limitations helps in making informed decisions about additional insurance options to ensure comprehensive protection.

Understanding primary liability requirements is paramount for owner-operators to ensure they’re adequately protected. Physical damage policies play a crucial role in mitigating risks associated with operational activities, but they have limitations that must be appreciated. By grasping these concepts, owner-operators can make informed decisions when selecting coverage, ensuring they’re not left vulnerable in the face of potential claims and financial burdens. This knowledge equips them to navigate the complexities of liability management effectively.