For business owners operating commercial vehicles or heavy machinery, owner-operator coverage is crucial for protecting against risks and liabilities beyond just physical damage coverage. This specialized insurance offers tailored protections, including financial safeguard in case of accidents, theft, or damage, shielding business owners from liability claims. By partnering with insurers specializing in this area, owner-operators can gain comprehensive solutions like replacement parts, roadside assistance, and swift claim settlements, ensuring business continuity and peace of mind in a high-risk industry.

“Maximizing business efficiency and mitigating risks go hand in hand. For owner-operators, understanding and securing appropriate insurance is a strategic move. This article guides you through the intricacies of owner-operator coverage, emphasizing its significance for business owners. We explore why physical damage coverage is crucial and how partnering with insurers specializing in this domain offers unique advantages. Learn about the benefits of such collaboration, and gain practical tips to navigate the process effectively.”

Understanding Owner-Operator Coverage: Why It Matters for Business Owners

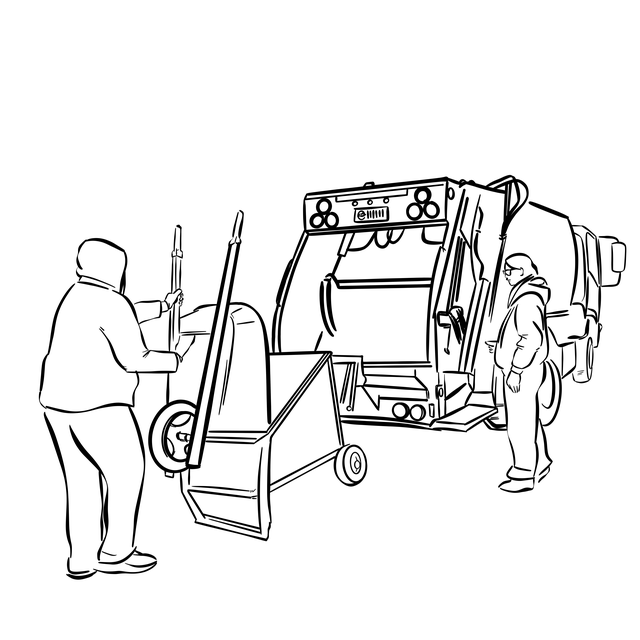

For business owners, especially those operating commercial vehicles or heavy machinery, understanding owner-operator coverage is paramount. This specialized insurance protects both the owner and operator of a vehicle against potential risks and liabilities. It’s not just about physical damage coverage; it encompasses a range of protections tailored to the unique needs of these individuals and businesses.

When operating a business that relies on vehicles, ensuring adequate insurance is crucial. Owner-operator coverage provides financial safeguard in case of accidents, theft, or damage to the vehicle. It also includes liability protection, shielding business owners from potential claims arising from operations. This type of insurance is a game-changer for owner-operators, offering peace of mind and financial security in an otherwise high-risk industry.

The Role of Insurers Specializing in Physical Damage Coverage

When it comes to protecting their investments, owner-operators greatly benefit from partnering with insurers who specialize in physical damage coverage. These experts are equipped to handle the unique risks associated with commercial vehicles and their operation. Physical damage coverage is a crucial component that protects owner-operators against financial loss in the event of accidents, natural disasters, or other unforeseen events causing harm to their vehicles. By insuring against such perils, owner-operators can ensure the continued operational capacity and longevity of their assets.

Specialized insurers offer tailored policies that extend beyond basic liability coverage. They understand that physical damage can result in significant costs for repairs or even total loss, which can cripple an owner-operator’s business. Therefore, these insurers provide comprehensive solutions, including replacement parts, roadside assistance, and swift claim settlements, ensuring owner-operators can get back on the road promptly. This level of support is invaluable, enabling them to focus on their core operations while relying on professionals to manage risks associated with physical damage.

Benefits of Partnering with Specialized Insurers for Owner-Operators

Partnering with insurers who specialize in owner-operator coverage offers several key advantages for businesses operating single vehicles or a small fleet. These specialized carriers understand the unique risks and needs of owner-operators, ensuring tailored policies that go beyond standard insurance offerings. By aligning with such insurers, owner-operators gain access to comprehensive physical damage coverage, protecting their assets from unexpected accidents or natural disasters.

Specialized insurers often provide customized solutions, including liability protection, cargo coverage, and specific endorsements for specialized vehicles. This tailored approach ensures that owner-operators are adequately insured, minimizing financial risks and offering peace of mind. Additionally, these partnerships can lead to competitive rates and flexible policy terms, allowing businesses to focus on their core operations while maintaining robust insurance coverage.

Navigating the Process: Tips for Effective Collaboration with Insurance Providers

Navigating the process of partnering with insurers specializing in owner-operator coverage requires a strategic approach to ensure effective collaboration. Start by thoroughly researching potential insurance providers, focusing on their expertise in physical damage coverage tailored for owner-operators. Compare policies, terms, and conditions to find the best fit for your specific needs.

Effective communication is key. Clearly articulate your requirements, especially regarding coverage limits, deductibles, and any additional services expected from the insurer. Regularly review policy details and stay informed about updates or changes that may impact your coverage. Proactive engagement with your insurance provider fosters a strong partnership, ensuring you’re both aligned in managing risks and claims efficiently.

Partnering with insurers who specialize in physical damage coverage for owner-operators is a strategic move that offers numerous benefits, from tailored protection to efficient claims handling. By navigating the process effectively and collaborating closely with these providers, business owners can ensure their operations remain resilient and sustainable against potential risks and damages. This approach underscores the importance of prioritizing insurance choices that align with the unique needs of owner-operators, fostering a robust and reliable business environment.