For independent drivers, liability insurance is a critical component of risk management. It protects against financial losses due to accidents or damage caused during work, including cargo-related incidents. Balancing coverage for liability insurance independent drivers, cargo protection, and physical damage with budget constraints is essential. Smart strategies involve comparing quotes, understanding deductibles, and customizing policies to meet specific needs without overspending, ensuring both risk mitigation and financial sustainability.

In today’s competitive landscape, understanding the nuances of insurance coverage is crucial for independent drivers navigating budgetary constraints. This article delves into essential aspects of liability, cargo, and physical damage coverage, tailored specifically for independent drivers. We explore strategies to balance comprehensive protection with financial feasibility. By examining key components like liability insurance, cargo coverage options, and cost-effective physical damage protections, drivers can make informed decisions that meet their unique needs without compromising their budget.

Understanding Liability Insurance for Independent Drivers

For independent drivers, navigating liability insurance is a crucial step in managing their business risks effectively. Liability insurance for independent drivers protects them from financial loss in the event that they are held responsible for damage or injury caused during the course of their work. This coverage is essential as it can shield drivers from significant out-of-pocket expenses, legal fees, and potential judgments.

Understanding liability insurance involves grasping key concepts like policy limits, deductibles, and covered events. Independent drivers should review their policies to ensure they offer adequate protection for their specific operations, including cargo handling, passenger transport, and vehicle maintenance practices. By making informed choices and staying within budget, independent drivers can secure comprehensive liability coverage that balances risk management with financial sustainability.

The Importance of Cargo Coverage within Your Budget

For independent drivers, managing liability insurance while navigating within a budget is a delicate balance. However, the importance of cargo coverage cannot be overstated. Protecting your cargo isn’t just about mitigating financial loss; it’s also about ensuring smooth operations and maintaining customer trust. Cargo coverage offers peace of mind by safeguarding your goods from damage or theft during transit, which can be particularly crucial for businesses relying on timely deliveries to stay competitive.

Understanding the scope of liability insurance specific to independent drivers is essential. This includes not just road accidents but also cargo-related incidents that could arise due to inadequate securing, weather conditions, or even hijacking. By evaluating your budget and prioritizing cargo coverage, you’re taking a proactive step towards minimizing potential losses. This ensures that should any unforeseen events occur, you’re protected and can continue providing reliable services without undue financial strain.

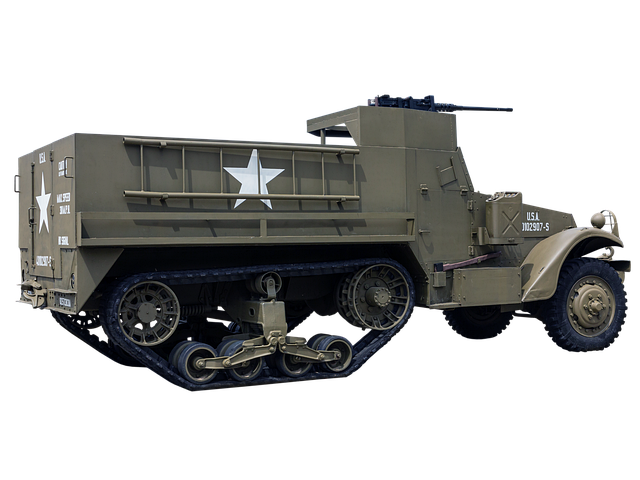

Physical Damage: Protecting Your Investment While Keeping Costs Low

Physical Damage protection is a critical component for any business involving independent drivers and cargo transportation, offering a safety net against unexpected incidents that could lead to significant financial losses. This coverage ensures that in the event of an accident or damage to vehicles, equipment, or goods during transit, your investment is secured. By including Physical Damage insurance, businesses can safeguard their assets while maintaining control over costs.

When exploring liability insurance options for independent drivers, it’s essential to find a balance between comprehensive protection and budget-friendly rates. Many insurers offer tailored policies that cater to the unique needs of transportation businesses. These policies typically include specific exclusions and limitations, allowing companies to choose coverage levels according to their risk assessment. By carefully reviewing policy details, businesses can ensure they are adequately protected without overspending on unnecessary aspects, thus maintaining a healthy budget for other operational expenses.

Balancing Coverage Needs and Financial Constraints

When exploring liability, cargo, and physical damage coverage for independent drivers within a budget, balancing coverage needs and financial constraints is paramount. Liability insurance, a crucial component, shields against potential claims arising from accidents or incidents involving the driver’s vehicle. However, selecting the right level of protection requires careful consideration.

Drivers must weigh the risks associated with their operations against the cost of premium payments. Opting for comprehensive yet affordable coverage can be challenging but essential. Smart choices include comparing quotes from various insurers, understanding deductibles, and customizing policies to cover specific needs without overloading budgets.

When exploring insurance options for your business, understanding the nuances of liability, cargo, and physical damage coverage is essential. By balancing your budget with these critical protections, you can ensure that your operations are secure while keeping costs manageable. Remember, the right coverage can safeguard your investment, protect your drivers, and maintain a competitive edge in today’s market. So, whether you’re an independent driver or a business owner, navigating these insurance requirements is a vital step towards a prosperous future.