As trucking companies grow, managing costs and coverage becomes a complex challenge. Optimizing expenses through efficient routing, modern fleet tech, and regular maintenance reduces operational costs. Tailored trucking policies, developed with specialized insurers, offer comprehensive protection against specific risks like accidents and breakdowns, ensuring financial stability and efficiency. These policies include flexible pricing models tailored to unique transportation needs, such as short-haul or specialized cargo, and allow for proactive coverage adjustments based on driver behavior and vehicle usage patterns, promoting long-term sustainability in a dynamic industry.

As your trucking company scales, balancing costs and coverage is crucial for sustainable growth. In this article, we explore strategies to manage key drivers of cost in trucking operations, from fuel efficiency to driver compensation. We delve into insurance and risk management techniques that can mitigate financial exposure. Furthermore, we discuss the importance of creating tailored trucking policies for varying scenarios, ensuring optimal protection without unnecessary expenses. By measuring and optimizing coverage as your fleet grows, you can achieve a delicate balance between cost and comprehensive protection.

Understanding Cost Drivers in Trucking Operations

As a trucking company scales, understanding cost drivers becomes crucial for balancing costs and coverage. Expenses in the trucking industry span from fuel and maintenance to driver salaries and insurance premiums. Each of these elements plays a significant role in overall operational costs, making them key areas for optimization. For instance, fuel costs can be mitigated through efficient routing and modern fleet technologies, while regular vehicle maintenance prevents costly breakdowns.

Tailored trucking policies help manage other significant expenses. Customized insurance plans, for example, can balance risk coverage with financial sustainability. Equally, employing strategic hiring practices to attract and retain skilled drivers can reduce turnover rates, cutting down on recruitment and training costs. By meticulously examining these cost drivers, trucking companies can make informed decisions to scale operations without compromising profitability.

The Role of Insurance and Risk Management Strategies

As a trucking company scales, balancing costs and coverage becomes increasingly complex. Insurance plays a pivotal role in risk management, offering financial protection against unforeseen events such as accidents, cargo damage, or vehicle theft. However, traditional insurance policies might not always align with the unique needs of trucking operations. This is where tailored trucking policies come into play.

By working with insurers who specialize in the trucking industry, companies can develop comprehensive coverage that considers specific risks associated with their fleet and routes. These tailored policies can include provisions for liability, cargo protection, driver safety, and even mechanical breakdowns, ensuring that businesses are well-protected as they expand their operations. Effective risk management strategies not only mitigate financial losses but also contribute to the overall efficiency and reliability of the trucking company.

Creating Tailored Trucking Policies for Different Scenarios

As your trucking company grows, so do the complexities of managing operations and costs. One effective strategy to balance coverage and expenses is by creating tailored trucking policies for distinct scenarios. This approach allows for flexible pricing models that cater to various customer needs while optimizing operational efficiency.

By analyzing different transportation requirements, you can design specific policies for short-haul, long-distance, or specialized cargo transports. Tailored policies might include variable rate structures, fuel surcharge adjustments, or discounted rates for consistent, high-volume clients. This level of customization ensures that your trucking company offers competitive pricing without compromising the quality and coverage expected by your clients.

Measuring and Optimizing Coverage as Your Fleet Grows

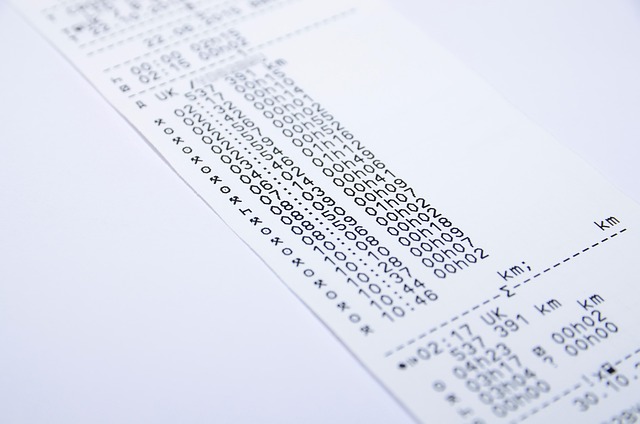

As your trucking company expands, so does the complexity of managing costs and coverage. One key aspect to focus on is optimizing your insurance coverage as your fleet grows. This involves a nuanced understanding of risk assessment and the ability to tailor trucking policies that align with your specific needs. By meticulously analyzing driver behavior, vehicle usage patterns, and geographic routes, you can identify areas where coverage can be adjusted without compromising safety or legal compliance.

Regular reviews of your insurance policies allow for the removal of unnecessary provisions or the addition of targeted protections based on your company’s evolving profile. Implementing these adjustments ensures that your coverage remains cost-effective while providing comprehensive protection against potential risks. This proactive approach not only streamlines your operations but also contributes to long-term financial sustainability in a dynamic trucking industry.

As your trucking company scales, balancing costs and coverage is crucial. By understanding cost drivers, implementing effective risk management strategies, and creating tailored trucking policies for diverse scenarios, you can optimize operations and ensure comprehensive protection. Measuring and regularly reviewing your coverage ensures that your fleet grows with the right support, making it a game-changer in today’s competitive industry.