Comprehensive truck insurance is essential for commercial trucking businesses to safeguard against diverse risks like vehicle damage, theft, cargo loss, and on-the-road accidents. It offers broader protection than basic liability, ensuring business continuity, financial stability, and peace of mind. To choose the best policy, businesses should carefully assess their operational needs and research reputable insurance providers specializing in comprehensive truck insurance. Top-tier services include expert risk management guidance, quick claim support, and personalized attention.

Navigating the complex landscape of commercial truck insurance can be daunting. Understanding your options, ensuring adequate coverage, and knowing how to file a claim are crucial aspects of risk management for any trucking business. This article delves into these key areas, offering insights on finding professional support to maximize benefits. From comprehending various policy types to exploring claims assistance, we provide a guide to help trucking operations make informed decisions regarding their comprehensive truck insurance needs.

- Understanding Your Commercial Truck Insurance Options

- The Importance of Comprehensive Truck Insurance Coverage

- How to Find and Choose the Right Professional Support

- Maximizing Benefits: Navigating Claims and Support Services

Understanding Your Commercial Truck Insurance Options

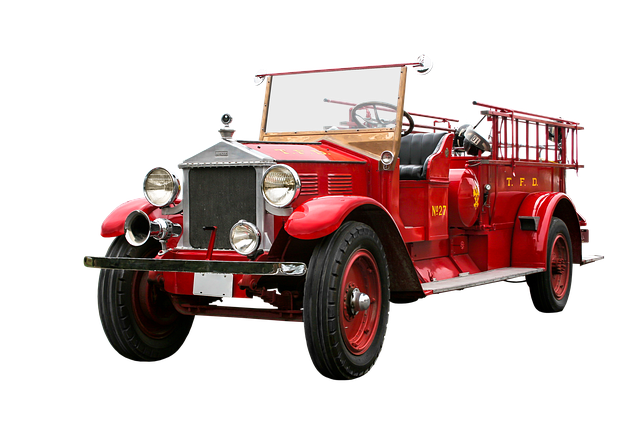

When it comes to insuring your commercial trucks, understanding your options is key. Comprehensive truck insurance goes beyond basic liability and covers a wide range of potential risks specific to the trucking industry. From damage to your vehicle due to accidents or natural disasters, to theft or vandalism, comprehensive insurance provides peace of mind by ensuring you’re protected financially in various unforeseen circumstances.

This type of insurance also includes coverage for cargo, offering protection against loss or damage during transportation. It’s essential for businesses to assess their specific needs and choose a policy that aligns with their operations, whether they’re hauling goods across states or locally delivering packages. By selecting the right comprehensive truck insurance, businesses can safeguard their investments and minimize financial losses in the event of unforeseen events.

The Importance of Comprehensive Truck Insurance Coverage

Comprehensive truck insurance is more than just a legal requirement; it’s a safety net that protects businesses and their valuable assets on the road. In the dynamic world of commercial trucking, where unexpected events can arise at any moment, having robust insurance coverage is paramount. This type of insurance goes beyond basic liability by offering protection against a wide range of potential risks and losses.

It encompasses various scenarios, including damage or theft of the vehicle, liability for on-the-road accidents involving other parties, and even comprehensive coverage for cargo during transit. By investing in comprehensive truck insurance, business owners can mitigate financial burdens, ensure operational continuity, and maintain peace of mind, knowing their investment is secured against unforeseen circumstances that may disrupt their trucking operations.

How to Find and Choose the Right Professional Support

Choosing the right professional support for your commercial truck insurance needs is a crucial step in ensuring you have the best coverage and peace of mind. Start by researching and comparing various providers specializing in comprehensive truck insurance. Look for companies with a strong reputation, deep industry knowledge, and experience catering to the unique risks faced by trucking businesses. Online reviews and testimonials from fellow trucking operators can be invaluable insights into a provider’s reliability.

During your search, consider the breadth of services offered. Top-tier professional support should go beyond basic insurance; they should provide guidance on risk management, regulatory compliance, and loss prevention strategies tailored to the trucking industry. Effective communication channels, quick response times, and personalized attention are also key indicators of a provider committed to customer satisfaction.

Maximizing Benefits: Navigating Claims and Support Services

When it comes to commercial truck insurance, maximizing benefits is key for businesses to protect their investments and keep operations running smoothly. Comprehensive truck insurance offers a wide range of coverage options that go beyond basic liability, including protection against cargo loss or damage, accidental vehicle theft, and on-the-road emergencies. This ensures that fleet managers can focus on their core business activities without worrying about unexpected financial burdens.

Navigating claims and support services is an essential aspect of comprehensive truck insurance. Professional support teams provide crucial assistance during difficult times, guiding policyholders through the claim process efficiently. From reporting accidents to negotiating with third-party providers, these experts ensure that every step is handled promptly and accurately. This not only reduces stress for businesses but also maximizes their compensation, allowing them to get back on the road faster with minimal disruption to their operations.

When it comes to commercial truck insurance, having the right support is key. By understanding your options, prioritizing comprehensive truck insurance coverage, and selecting professional guidance, business owners can navigate risks effectively. Remember, the right support can make all the difference in maximizing benefits and ensuring a smooth claims process. So, take a dive into these insights and choose the best path forward for your trucking enterprise.