Trucking insurance tailored for owner-operators is a vital aspect of their business, offering affordable and specialized coverage that addresses the unique risks associated with independent trucking. This includes essential liability insurance for solo drivers and comprehensive cargo insurance to protect valuable freight. Physical damage policies are available to safeguard the trucks themselves against collisions, theft, or natural disasters. The key advantage is scalability; these tailored policies adapt to the growth or contraction of owner-operators' businesses, ensuring they maintain robust protection while keeping costs in check. As a result, independent truckers can optimize their expenses, ensuring they remain adequately covered and competitive in the dynamic trucking industry, ready to navigate growth strategically with appropriate insurance coverage in place. Owner-operators benefit from scalable trucking coverage that evolves with their operations, providing a financial safeguard against unforeseen events on the road, thereby securing their business's long-term success and resilience.

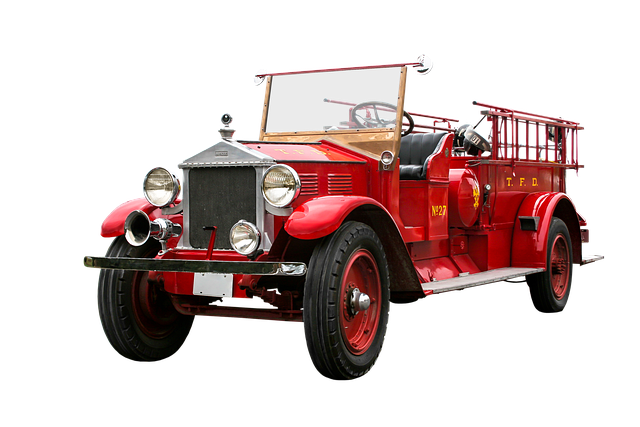

In the dynamic and demanding realm of trucking, independent owner-operators and small fleet owners are increasingly seeking tailored insurance solutions that adapt to their growth trajectory. This article delves into the essential aspects of scalable trucking insurance options designed to maximize profitability while ensuring comprehensive coverage for liability and cargo. We explore how affordable owner-operator insurance and physical damage policies can bolster business resilience, making them indispensable for solo drivers navigating the complexities of the industry. As independent truckers expand their operations, having scalable coverage becomes a strategic investment in both their financial stability and operational success.

Maximizing Profitability: Tailored Coverage for Independent Truckers

In the realm of independent trucking, where profitability hinges on efficient operations and risk management, owner-operators must prioritize tailored coverage for their ventures. Trucking insurance specifically designed for owner-operators is pivotal in ensuring both financial stability and peace of mind on the road. These policies can include affordable liability insurance tailored for solo drivers, safeguarding against potential third-party claims that could arise from accidents or incidents involving cargo. Moreover, cargo insurance for owner-operators is indispensable, protecting one of the most valuable assets in the trucking business—the freight itself. Ensuring comprehensive physical damage policies for the trucks and coverage options that scale with the growth of the operation are key factors in maintaining a competitive edge while maximizing profitability.

As the trucking industry expands, scalable trucking coverage becomes increasingly important for owner-operators. The ability to adjust insurance needs as business volume fluctuates is crucial for maintaining operational efficiency and cost-effectiveness. Scalable coverage allows these entrepreneurs to increase or decrease their levels of protection in tandem with changes in their business operations. This flexibility means that owner-operators can tailor their insurance packages to their current needs without overpaying for services they don’t require, thereby optimizing their overall expenses and enhancing their bottom line. By leveraging scalable trucking insurance options, independent truckers can ensure they are both adequately protected and financially astute in their business decisions.

Navigating Growth: Scalable Insurance Solutions for Trucking Owner-Operators

As trucking owner-operators navigate the complexities of growth and expansion, securing tailored coverage for independent truckers becomes a pivotal aspect of their business strategy. The trucking insurance market offers a range of options designed to cater specifically to the needs of owner-operators, providing affordable owner-operator insurance solutions that adapt as your fleet grows or contracts. These policies are not one-size-fits-all; they are crafted to protect against the unique risks associated with solo driving, including comprehensive liability insurance and cargo insurance for owner-operators. Ensuring the safety of your cargo is paramount, and having robust physical damage policies in place can safeguard your investment from unforeseen events such as collisions, theft, or natural disasters.

In the realm of scalable trucking coverage, it’s essential to consider the adaptability of insurance solutions as your operations evolve. Whether you’re adding more trucks to your fleet or venturing into new territories, your insurance should be able to expand with your business. Liability insurance for solo drivers is a critical component that addresses the legal implications of being on the road, while cargo insurance owner-operators can provide peace of mind that the lifeblood of your business—the goods you transport—is protected. By partnering with insurance providers who understand the dynamic nature of trucking businesses, owner-operators can ensure they have the necessary coverage to navigate growth confidently and responsibly.

The Importance of Affordable Owner-Operator Liability and Cargo Insurance in the Trucking Industry

In the realm of trucking, where the roads are as vast as the responsibilities, owner-operators and solo drivers must navigate the complexities of liability and cargo insurance with precision. Trucking insurance for owner-operators is not just a financial safeguard but an indispensable tool that can shield them against unforeseen events. Tailored coverage for independent truckers ensures that their livelihoods are protected from the risks inherent in the industry, providing peace of mind as they traverse America’s highways and byways. Affordable owner-operator insurance is a cornerstone of sustainable growth, allowing these entrepreneurs to manage costs while maintaining critical protection against third-party claims, which can arise from even the most routine of deliveries.

Moreover, cargo insurance for owner-operators is an essential component of comprehensive trucking coverage. The value of goods transported varies greatly, and tailored policies that cover physical damage to trucks as well as the cargo they carry are vital. These policies are designed to be scalable, adapting to the specific needs of each operation, whether it’s a local run or a cross-country haul. As trucking businesses expand and routes become more complex, having scalable trucking coverage becomes increasingly important for long-term success, ensuring that every load is not just insured but supported by a robust and responsive insurance framework.

Ensuring Business Resilience with Physical Damage Policies for Solo Drivers

For trucking insurance owner-operators seeking resilience and protection against unforeseen events, tailored coverage for independent truckers is paramount. These policies are specifically designed to cater to the unique needs of solo drivers who own and operate their trucks. A robust physical damage policy ensures that in the event of an accident or other incidents, the truck can be repaired or replaced without undue financial strain. This not only safeguards the trucker’s livelihood but also maintains their operational capacity. Furthermore, affordable owner-operator insurance options are available that provide comprehensive coverage, including liability insurance for solo drivers and cargo insurance for owner-operators. These scalable trucking coverage solutions are essential for adapting to growth, as they can be tailored to match the expanding needs of a business while keeping costs manageable. As such, investing in these insurance packages equips solo drivers with the financial support necessary to navigate the complexities of the trucking industry with confidence and security.

In conclusion, the trucking industry’s landscape is one of dynamic change, where growth presents both opportunities and challenges. For independent truckers and owner-operators alike, tailored coverage options are not just a safeguard but a strategic asset in maximizing profitability. As these professionals navigate the complexities of growth, scalable insurance solutions emerge as critical tools for maintaining operational resilience. Affordable owner-operator liability and cargo insurance, alongside comprehensive physical damage policies, ensure that solo drivers can continue their vital role in the supply chain with confidence. Embracing scalable trucking coverage is an indispensable step for those looking to thrive amidst expansion, safeguarding against unforeseen events while supporting long-term success.