Owner-operators in the trucking industry need robust vehicle protection, which includes physical damage coverage and collision insurance. Tailored policies offer comprehensive truck protection, covering everything from minor accidents to stolen items, at affordable rates. This ensures peace of mind, allowing them to focus on their routes while safeguarding their investments. By prioritizing these tailored solutions, independent truckers can maintain reliable operations and protect against costly repairs or total vehicle loss.

In today’s dynamic trucking industry, a comprehensive and cost-effective insurance solution is paramount for owner-operators. This article guides you through the essential components of truck insurance, focusing on physical damage coverage tailored to meet specific needs. We explore collision insurance as a vital shield for independent truckers, delving into affordable vehicle damage insurance options that maximize repair and replacement coverage without straining budgets. By combining these policies, owner-operators can achieve peace of mind on the road.

Understanding Physical Damage Coverage for Owner-Operators

For owner-operators, ensuring comprehensive protection for their vehicles is paramount, especially considering the risks inherent in the trucking industry. Physical damage coverage plays a crucial role in this regard, offering owner-operators a robust safety net against unexpected vehicle damages. This type of insurance is designed to provide repair and replacement coverage for trucks involved in accidents or incidents, including collisions with other vehicles, objects, or even natural disasters.

Tailored physical damage policies specifically cater to the unique needs of independent truckers. Collision insurance for owner-operators typically covers not just the cost of repairs but also replaces damaged or stolen parts, offering peace of mind behind the wheel. Such coverage is affordable and can be customised to fit individual budgets while ensuring that owner-operators are protected against significant financial burdens associated with vehicle damage. With comprehensive truck protection, folks in this industry can focus on their routes, safe in the knowledge that their investment is secured.

Collision Insurance: A Vital Shield for Independent Truckers

Collision Insurance serves as an indispensable shield for independent truckers, offering crucial protection against unforeseen physical damage to their vehicles. This type of insurance is particularly tailored to cover the unique risks faced by owner-operators on the road, ensuring they have comprehensive truck protection. By providing repair and replacement coverage, it safeguards against costly repairs or even total vehicle loss due to collisions, which are inherent risks in the trucking industry.

For independent truckers looking for a cost-effective solution, tailored physical damage policies like collision insurance are an excellent choice. These policies go beyond basic liability coverage, offering affordable vehicle damage insurance that fits their operational needs. By prioritizing this form of protection, owner-operators can maintain their vehicles in top condition, minimize financial setbacks from accidents, and continue to provide reliable services without the added burden of unexpected repair expenses.

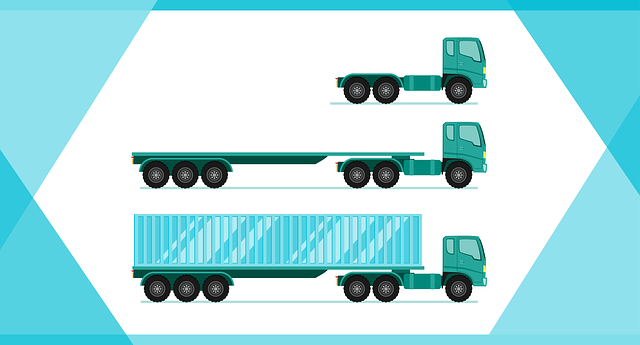

Comprehensive Truck Protection: Tailored Policies for Complete Peace of Mind

For owner-operators and independent truckers navigating the road, ensuring comprehensive protection for their vehicles is paramount. This is where comprehensive truck protection policies shine as a game-changer. These tailored solutions go beyond traditional collision insurance by offering a robust suite of benefits designed to safeguard against various risks unique to the trucking industry.

By bundling features like physical damage coverage, repair and replacement coverage, and protection against unforeseen events, these policies provide affordable vehicle damage insurance without breaking the bank. This holistic approach ensures that owner-operators can hit the road with complete peace of mind, knowing they’re prepared for any eventuality, from minor fender benders to significant collisions or natural disasters.

Affordable Vehicle Damage Insurance: Maximizing Repair and Replacement Coverage Without Breaking the Bank

For owner-operators and independent truckers, navigating the complexities of insurance can be challenging, especially when it comes to protecting their vehicles from potential damage. Collision insurance is a crucial component for any trucker’s portfolio, offering financial protection against the costs associated with accidents. However, finding the right balance between comprehensive coverage and affordability is essential to ensure the financial viability of these businesses.

Enter affordable vehicle damage insurance—a tailored solution designed to maximize repair and replacement coverage without breaking the bank. This specialized policy goes beyond basic collision coverage by encompassing a wide range of physical damage scenarios, from fender benders to more severe accidents. By understanding their specific needs and risk factors, owners can customize their policies to include comprehensive truck protection, ensuring that their vehicles are covered for both routine wear and tear as well as unexpected events. This proactive approach enables independent truckers to maintain their fleets in top condition, minimizing downtime and associated costs related to damage repairs.

Combining policies offers a comprehensive and cost-effective solution for owner-operators, independent truckers, and anyone seeking tailored physical damage protection. By aligning collision insurance, comprehensive truck protection, and affordable vehicle damage insurance, individuals can maximize repair and replacement coverage while maintaining financial stability. This multi-layered approach ensures complete peace of mind on the road, allowing focus to remain on safe and efficient transportation.