Commercial truck insurance is essential for trucking businesses to safeguard their investments. Key components include truck liability insurance for accident coverage, comprehensive truck insurance protecting against natural disasters, theft, and vandalism, and custom truck insurance tailored to specific business needs. Comprehensive coverage ensures trucks, drivers, and assets are protected during every journey, fostering safer environments, mitigating financial risks, and maintaining operational continuity. Customized policies consider fleet size, driving history, and industry needs for personalized commercial vehicle protection.

In the dynamic world of commercial trucking, ensuring legal compliance and financial protection is paramount. This article guides you through essential aspects of commercial truck insurance, offering insights into various types and coverage options that cater to diverse fleet needs. From understanding comprehensive business truck insurance for risk mitigation to navigating truck liability insurance, we explore strategies to safeguard your business and drivers. Additionally, discover how customized truck insurance plans can tailor protection for unique fleet requirements, ensuring peace of mind on the road ahead.

- Understanding Commercial Truck Insurance: Types and Coverage Options

- The Importance of Comprehensive Business Truck Insurance for Risk Mitigation

- Navigating Truck Liability Insurance: Protecting Your Business and Drivers

- Customized Truck Insurance Plans: Tailoring Protection for Unique Fleet Needs

Understanding Commercial Truck Insurance: Types and Coverage Options

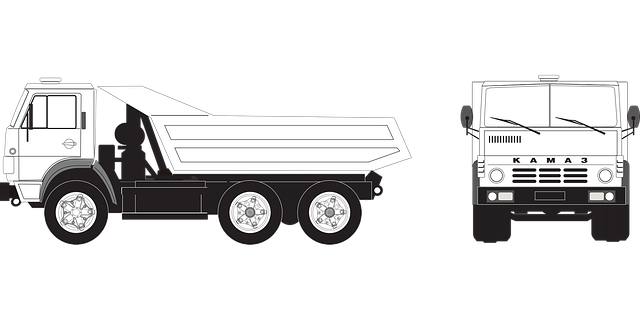

Commercial truck insurance is a crucial aspect of managing a trucking business. It provides essential financial protection against various risks and liabilities that come with operating commercial vehicles. Understanding the different types of coverage available is vital for any business owner looking to safeguard their investment and avoid significant financial losses. Business owners can tailor their truck insurance policy to fit specific needs, ensuring comprehensive vehicle protection.

There are several key components to consider when discussing commercial trucking insurance. Truck liability insurance is a basic requirement, covering damages caused by accidents involving the insured vehicles. Comprehensive truck insurance, on the other hand, offers broader protection, encompassing not just accidents but also damage from natural disasters, theft, and vandalism. For unique or custom trucks, specific plans may be needed to account for specialized parts and builds. Commercial vehicle coverage is a broad term that encompasses various policies designed to protect trucking businesses, ensuring they remain operational and financially secure despite unexpected events.

The Importance of Comprehensive Business Truck Insurance for Risk Mitigation

In the dynamic and high-risk world of commercial trucking, one of the most crucial aspects of risk management is securing comprehensive business truck insurance. This vital coverage acts as a protective shield for trucking businesses, drivers, and their assets, offering peace of mind in an industry where unforeseen circumstances can arise at any moment. Commercial vehicle coverage, specifically designed for the unique challenges faced by trucking operations, encompasses a wide range of potential risks, from accidents and cargo damage to liability claims and natural disasters.

A robust truck insurance policy should include elements such as truck liability insurance, which protects against third-party damages and legal costs, and comprehensive truck insurance that covers a multitude of other perils, including vehicle theft, vandalism, and weather-related incidents. Custom truck insurance plans allow businesses to tailor their coverage to fit specific operational needs, ensuring that they are adequately protected throughout their trucking journeys. By investing in such measures, trucking companies can mitigate financial losses, safeguard their operations, and ensure the safety of their drivers on the road.

Navigating Truck Liability Insurance: Protecting Your Business and Drivers

Navigating Truck Liability Insurance is a critical aspect of running a successful trucking business. With comprehensive commercial truck insurance in place, operators can protect their assets and drivers from potential risks and financial losses. The right truck insurance policy should offer more than just liability coverage; it should include comprehensive vehicle protection to safeguard against accidents, natural disasters, and vandalism. Commercial vehicle coverage tailored to your specific needs ensures that your business remains resilient in the face of unforeseen circumstances.

Custom truck insurance plans allow trucking companies to customize their policies based on factors like fleet size, driving history, and specific industry requirements. This level of customization ensures that each business receives protection suited to its unique operations. By prioritizing comprehensive commercial trucking insurance, operators can foster a safer working environment for drivers, mitigate financial risks, and maintain the operational continuity of their businesses.

Customized Truck Insurance Plans: Tailoring Protection for Unique Fleet Needs

In the realm of commercial trucking, one size does not fit all when it comes to insurance. That’s where Customized Truck Insurance Plans come into play. These tailored policies are designed to meet the unique needs of each trucking business, offering more than a standard commercial vehicle coverage. By assessing factors like fleet size, driving history, and specific operations, insurers can craft comprehensive truck insurance policies that encompass liability, cargo protection, and even specialized risks. This personalized approach ensures that trucking businesses receive robust financial protection tailored to their specific activities.

Business owners no longer need to settle for one-size-fits-all commercial truck insurance plans. Customized options allow them to bundle different coverage types, such as comprehensive, collision, and roadside assistance, creating a comprehensive risk management strategy. Moreover, these plans can include specific endorsements for specialized trucking operations, ensuring that businesses are adequately protected against potential losses. This level of customization is crucial in mitigating risks associated with the unpredictable nature of trucking, providing peace of mind for business owners and their drivers.

In ensuring the safety and financial security of your trucking operations, securing adequate commercial truck insurance is non-negotiable. By understanding the various types of coverage, like comprehensive business truck insurance and truck liability insurance, and tailoring a policy to fit your unique fleet needs through custom truck insurance plans, you can mitigate risks and protect both your business and drivers. In today’s competitive landscape, embracing comprehensive vehicle protection isn’t just a best practice; it’s a crucial strategy for long-term success in the trucking industry.