Effective legacy planning ensures your wealth transfer aligns with your wishes while protecting and growing family wealth across generations. By engaging a legacy lawyer, you receive strategic guidance on estate legacy planning, inheritance planning, and asset transfer methods, from basic will preparation to complex multi-generational wealth strategies. This expert helps manage wealth distribution strategies, mitigate tax implications, and facilitate open communication about future generations' expectations, ultimately securing family wealth for current and future descendants.

Transferring wealth seamlessly and effectively is the cornerstone of legacy planning, ensuring your assets contribute to the security and prosperity of future generations. This article explores tailored solutions for managing and distributing your wealth, focusing on multi-generational strategies and estate legacy planning. We’ll delve into asset transfer techniques, highlighting the importance of choosing the right legal counsel to navigate inheritance planning and secure family wealth protection. Discover how these approaches can safeguard and grow your legacy.

- Understanding Wealth Transfer: The Foundation of Legacy Planning

- Asset Transfer Strategies for Multi-Generational Wealth

- Estate Legacy Planning: Securing Your Family's Future

- Choosing the Right Lawyer: Protecting and Distributing Your Wealth

Understanding Wealth Transfer: The Foundation of Legacy Planning

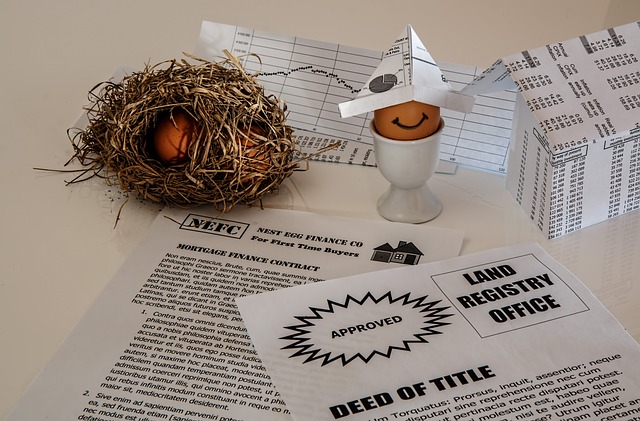

Wealth transfer is a fundamental aspect of legacy planning, ensuring that your assets are distributed according to your wishes while safeguarding the future financial security of your loved ones. This process involves careful consideration and strategic planning to manage and move your estate across generations, creating a lasting impact. It’s not just about transferring money or property; it encompasses the entire journey of preserving and growing wealth for the benefit of future generations.

Estate legacy planning, often facilitated by a legacy lawyer, involves crafting strategies that align with your goals. This includes deciding when, how, and to whom assets will be transferred, taking into account tax implications and wishes for specific family members or charitable causes. By implementing robust wealth distribution strategies, you can protect your family’s wealth, provide for future generations’ needs, and ensure your legacy endures.

Asset Transfer Strategies for Multi-Generational Wealth

In the context of multi-generational wealth transfer, strategic asset allocation plays a pivotal role in ensuring a smooth and secure transition from one generation to the next. Estate planning lawyers recommend tailored strategies that consider not only the financial aspects but also the emotional and familial dynamics involved. Effective asset transfer involves creating comprehensive plans that include various tools such as trusts, wills, and insurance policies. These mechanisms facilitate controlled distribution of wealth, aligning with the legacy goals set by the original owners.

By integrating legacy planning into estate management, families can safeguard their hard-earned assets while fostering a harmonious continuation of their financial legacies. A well-designed asset transfer strategy not only protects future generations but also empowers them to thrive. This proactive approach to wealth distribution ensures that family wealth remains intact and is managed responsibly over time, serving as a lasting testament to the original owner’s forward-thinking vision.

Estate Legacy Planning: Securing Your Family's Future

Estate Legacy Planning plays a pivotal role in securing the future financial well-being of your loved ones. It involves strategic asset transfer and wealth distribution strategies tailored to ensure that your hard-earned multi-generational wealth is managed responsibly and passed on efficiently to future generations. Engaging a legacy lawyer can be invaluable, as they guide you through complex inheritance planning, enabling you to create a robust framework for managing and protecting your estate.

This proactive approach goes beyond mere financial transactions; it’s about safeguarding your family’s legacy. By implementing thoughtful estate legacy planning, you can ensure that your wealth is distributed according to your wishes while mitigating potential tax implications. This process also helps in fostering open communication about future generations’ expectations, ensuring a smoother transition of both assets and values from one generation to the next.

Choosing the Right Lawyer: Protecting and Distributing Your Wealth

When it comes to transferring your wealth and planning for future generations, selecting the right legal counsel is paramount. The chosen lawyer should have extensive experience in estate legacy planning and be well-versed in various asset transfer methods, from straightforward will preparation to more complex multi-generational wealth strategies. Look for a legacy lawyer who understands your unique circumstances and can guide you through the intricacies of inheritance planning.

This expert will help ensure that your wishes are accurately reflected in legal documents, while also providing valuable insights into wealth distribution strategies. They will navigate the process of securing your estate’s future, protecting family wealth, and implementing effective plans to benefit both current and future generations.

When crafting your legacy, effective wealth transfer is key. By understanding the various asset transfer strategies and consulting with a legacy lawyer, you can ensure a smooth transition of your multi-generational wealth while securing the future of your family. Estate legacy planning, when done thoroughly, becomes a powerful tool to protect and distribute your hard-earned assets according to your wishes, providing peace of mind for both yourself and your loved ones.