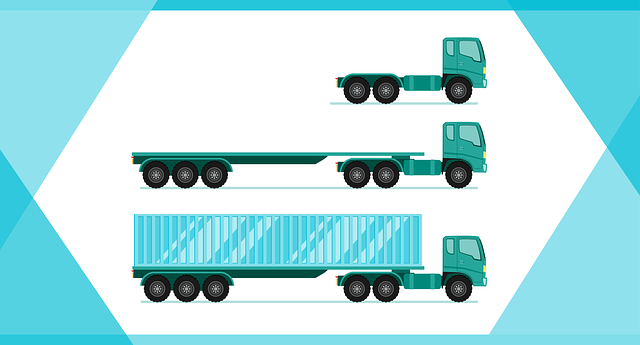

Small fleet owners in the trucking industry need liability insurance to protect against accidents and damage. Fleet liability coverage includes options like cargo liability insurance for lost or damaged goods and multi-truck liability policies for businesses with multiple vehicles. Affordable fleet insurance tailored to small fleets ensures compliance, adequate protection, and streamlined claims processes. Commercial fleet insurance, suitable for larger operations, offers enhanced coverage and risk management services. Securing appropriate liability insurance at competitive rates involves exploring specialized options catering to small fleets' unique risks and needs, including cargo liability insurance and multi-truck liability policies.

Navigating the complex landscape of liability insurance for your small fleet or trucking business can be a daunting task. Understanding the nuances of general and auto liability coverage is essential to protect your operation from significant financial risks. This comprehensive guide dives into crucial aspects, including general liability insurance for small fleets, the importance of auto liability coverage in trucking, exploring affordable options, and managing cargo liability with multi-truck policies. By the end, folks will be equipped with knowledge to make informed decisions for their commercial fleet insurance needs.

Understanding General Liability Insurance for Small Fleets

For small fleet owners operating trucks or other vehicles in the trucking and transportation industry, understanding General Liability Insurance (GLI) is paramount. This type of insurance protects against potential risks and liabilities that can arise from accidents, damages to property, or injuries to third parties. In the case of a claim, GLI covers the associated costs, including legal fees and compensation payments. For small fleets, choosing an affordable fleet insurance policy that offers adequate coverage is crucial, ensuring compliance with local regulations while safeguarding against financial strain in the event of unforeseen incidents.

A comprehensive look at fleet liability coverage reveals various components tailored to specific needs. Cargo liability insurance protects against losses incurred due to damaged or lost cargo during transit. Multi-truck liability policies, as the name suggests, provide protection for multiple vehicles under a single policy, streamlining the claims process and potentially reducing costs. Commercial fleet insurance, designed for businesses with larger fleets, often includes enhanced coverage options and risk management services, making it suitable for those seeking robust protection for their operations.

Auto Liability Coverage: Protecting Your Trucking Business

Auto Liability Coverage is an indispensable component for any trucking business aiming to safeguard its operations and financial stability. As a small fleet owner, you face unique challenges on the road, from managing multiple trucks to ensuring the safety of your cargo. Commercial fleet insurance tailored for liability protection steps in as a robust shield against potential risks and claims.

By opting for comprehensive fleet liability coverage, you can rest assured that your business is shielded from financial ruin in the event of an accident involving one or more of your vehicles. This includes not just damage to other properties but also injuries or fatalities sustained by individuals involved. Affordable fleet insurance policies designed for small fleets offer a range of options, including cargo liability insurance, which protects against loss or damage to the goods you transport, and multi-truck liability policies that provide extended coverage for businesses with larger operations.

Exploring Affordable Options for Commercial Fleet Insurance

Many businesses operating small fleets, whether it’s a few trucks for a local delivery service or a fleet of vans for a small transportation company, face a critical task: securing adequate liability insurance at an affordable price. With rising insurance costs across the board, finding cost-effective solutions for commercial fleet insurance can be challenging. However, exploring tailored options specifically designed for smaller operations can unlock competitive rates without compromising on protection.

Trucking businesses and their operators should consider their unique risks, including cargo liability, property damage, and personal injuries associated with fleet operations. Affordable fleet insurance policies offer specialized coverage for these concerns, ensuring small fleets are protected against potential financial disasters. These multi-truck liability policies often come with flexible options to meet individual business needs, allowing for customized solutions without breaking the bank.

Navigating Cargo Liability and Multi-Truck Policies

Navigating Cargo Liability and Multi-Truck Policies is a crucial step for any trucking business aiming to ensure comprehensive protection. For small fleets, managing liability insurance requires balancing coverage with cost-effectiveness. Affordable fleet insurance options exist that cater specifically to the unique needs of these operations, offering fleet liability coverage that includes protection against claims related to cargo damage or loss. This is particularly important as commercial fleet insurance often extends beyond vehicle accidents, encompassing also the goods being transported.

Multi-truck liability policies are designed for businesses operating multiple vehicles, providing a seamless solution for risk management. These policies can offer significant advantages by pooling risks and potentially reducing premiums. For trucking businesses, this means not only access to more affordable commercial fleet insurance but also enhanced protection against the financial burden of cargo-related incidents. Thus, when navigating liability insurance requirements, small fleet operators should explore both cargo liability insurance and multi-truck liability policies to secure their operations and maintain competitive costs.

When it comes to protecting your trucking business and ensuring compliance with liability insurance requirements, understanding the various types of coverage available is key. From general liability for small fleets to specialized auto liability and cargo liability insurance, there are options tailored to meet the unique needs of commercial fleet operations. By exploring affordable fleet insurance solutions and considering multi-truck liability policies, businesses can navigate the complex landscape of liability protection effectively, ensuring peace of mind on the road ahead.