Small fleet owners can significantly reduce insurance costs by understanding their vehicles' unique roles and risks. Instead of a one-size-fits-all approach, identify gaps in coverage like cargo-related risks not covered by general liability. Evaluating operations helps pinpoint overlaps, allowing for tailored policies. Bundling physical damage and cargo insurance, along with fleet discounts on comprehensive policies, offers budget-friendly options while maintaining adequate protection. A comprehensive risk assessment optimizes costs by targeting specific needs, avoiding unnecessary expenses, and securing targeted discounts. This proactive approach ensures cost-effective fleet policies without compromising quality coverage.

In today’s competitive landscape, small fleets strive for budget-friendly fleet insurance without compromising on coverage. Combining multiple policies strategically can significantly reduce costs for trucking and other commercial vehicles. This article provides a roadmap to achieving low-cost trucking insurance by understanding your fleet’s unique needs, exploring creative policy bundles, leveraging discounts, conducting comprehensive risk assessments, and securing physical damage and liability coverage at affordable rates. Discover how these strategies can help you navigate the market for optimal budget-friendly fleet insurance.

Understanding Your Fleet's Unique Needs: Identify Gaps and Overlaps in Coverage

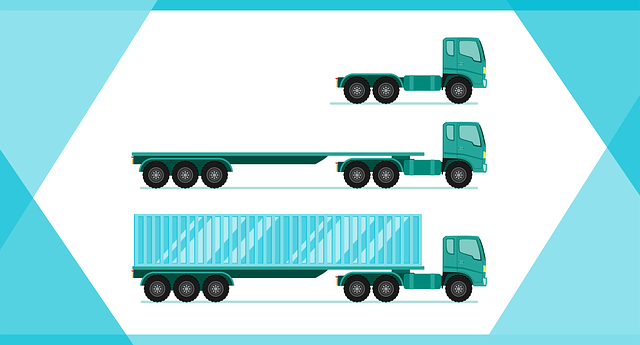

When it comes to insuring your small fleet, understanding each vehicle’s unique role and associated risks is paramount. Every truck or van in your fleet may have distinct needs, operating conditions, and potential exposure to different types of losses. This means that a one-size-fits-all approach won’t cut it when it comes to insurance. You’ll want to identify any gaps in coverage for specific scenarios where your current policies might not adequately protect you. For instance, while general liability covers accidents causing property damage or injuries to others, it may not account for specific cargo-related risks. In such cases, additional cargo insurance could be a cost-effective solution to fill this gap.

By thoroughly evaluating the operations of your fleet, you can pinpoint overlaps in coverage as well. For example, physical damage insurance is essential for protecting against accidents and mechanical failures, but if your vehicles are primarily used for short-haul local deliveries with minimal risk, a comprehensive policy might be overkill and lead to unnecessary expenses. Identifying these overlaps allows you to tailor your policies, ensuring that you’re not paying for redundant coverage while still maintaining adequate protection for your small fleet’s unique needs.

Creative Policy Bundling: Explore Combinations for Cost Savings

In the world of trucking and fleet management, one effective strategy to achieve significant cost savings is through creative policy bundling. By exploring different combinations of insurance policies, small fleet owners can find affordable solutions that cater to their specific needs. For instance, pairing physical damage insurance with cargo insurance can provide comprehensive protection for vehicles and cargo, often at a lower rate than purchasing them separately. Similarly, combining liability coverage with fleet discounts can significantly reduce expenses, especially for those managing multiple vehicles.

This approach allows businesses to optimize their budget-friendly fleet insurance by taking advantage of bundled packages that offer both financial protection and cost efficiency. For small fleets looking to minimize spending on trucking insurance, exploring these creative combinations could be a game-changer. By carefully selecting policies that align with their operations, they can secure low-cost solutions without compromising on quality coverage, ensuring their assets and drivers are protected while keeping overheads low.

Leverage Fleet Discounts and Benefits: Maximize Savings on Multiple Policies

Many insurance providers offer significant discounts and benefits when insuring multiple vehicles or policies through a single plan. For small fleets, this presents a substantial opportunity to save on costs, especially for affordable insurance small fleets and low-cost trucking insurance. By bundling physical damage insurance and cargo insurance for fleets under one roof, businesses can achieve not only budget-friendly fleet insurance but also streamlined administration and potentially better coverage terms.

These savings are often more than just monetary; they extend to increased liability coverage for your fleet, ensuring comprehensive protection for both the vehicles and their precious cargo. This strategic approach to cost management is a game-changer, enabling small fleet owners to focus on their core operations while enjoying peace of mind knowing their investment is protected at competitive rates.

Comprehensive Risk Assessment: Mitigate Potential Losses for Budget-Friendly Insurance

Comprehensive Risk Assessment is a strategic approach that small fleet owners and operators can employ to optimize their insurance costs while ensuring adequate protection. By meticulously evaluating potential risks and hazards unique to their operations, businesses can tailor their insurance policies to cover specific needs, avoiding unnecessary expenses. This process involves analyzing every aspect of the fleet’s daily activities, from vehicle maintenance records to driver behavior patterns and route planning. Identifying high-risk areas allows insurers to offer targeted discounts and promotions, making budget-friendly fleet insurance more accessible. For instance, implementing rigorous safety protocols and regular vehicle inspections can lead to significant savings on physical damage insurance claims.

Additionally, a thorough risk assessment enables businesses to secure suitable liability coverage for their small fleets at competitive rates. Cargo insurance, in particular, protects against financial losses arising from cargo damage or theft during transit, which is crucial for maintaining a healthy bottom line. By mitigating potential losses through proactive measures, fleet owners can negotiate better terms and prices with insurers, ultimately achieving cost-effective fleet policies without compromising on protection. This strategic approach ensures that small fleets remain operationally efficient while navigating the complex landscape of insurance affordability.

Combining multiple policies is a strategic approach to achieving both comprehensive protection and significant cost savings for your small fleet. By understanding the unique needs of your vehicles and drivers, creatively bundling policies, leveraging available fleet discounts, and conducting thorough risk assessments, you can secure budget-friendly fleet insurance that covers all bases. This method allows business owners to focus on their core operations while ensuring minimal financial exposure from potential losses, making it an effective strategy for low-cost trucking insurance and small fleet liability coverage.