In a competitive trucking market, building resilience is crucial. Affordable policies, including budget-friendly fleet insurance and low-cost trucking coverage, offer new and small fleets financial protection against significant losses due to cargo, damage, and liability issues. These cost-effective solutions empower startups to focus on growth while keeping operational costs manageable, fostering long-term success. By evaluating tailored multi-truck insurance plans, fleet managers can ensure reliable operations, financial stability, and effective risk mitigation.

In today’s unpredictable economic climate, building long-term resilience is paramount for fleet operations. This article guides you through essential strategies to ensure your business thrives, focusing on affordable and reliable coverage options. We explore budget-friendly solutions tailored for small fleets, emphasizing the importance of comprehensive insurance plans for cargo protection. Additionally, we delve into navigating complex multi-truck insurance and startup fleet coverage, offering insights to mitigate risks and optimize costs for every stage of your operation.

Understanding the Importance of Long-Term Resilience for Fleet Operations

For fleet operations, building long-term resilience is paramount to navigate the unpredictable landscape of transportation and logistics. In today’s competitive market, where new fleets and small businesses enter constantly, ensuring operational continuity despite unforeseen events is a game-changer. Affordable policies for these emerging entities are not just about minimal financial outlay; they provide a safety net that safeguards against significant losses due to cargo protection, physical damage, and liability issues—common concerns for trucking operations.

Having reliable, budget-friendly fleet insurance options empowers startups and small fleets to focus on growth and efficiency. It allows them to secure multi-truck insurance plans tailored to their specific needs without breaking the bank. This accessibility to low-cost trucking coverage and small fleet liability insurance is pivotal in fostering a resilient environment where new fleets can thrive, ensuring they’re protected from potential risks while keeping operational costs manageable.

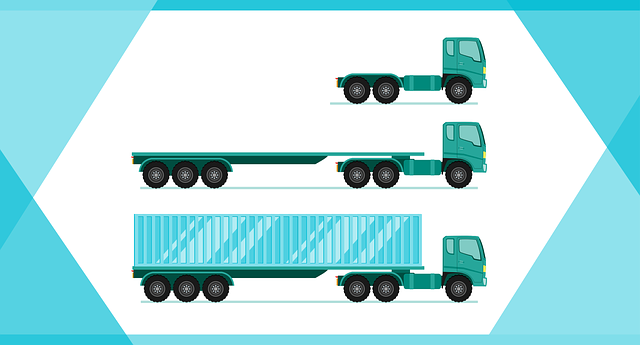

Exploring Budget-Friendly Coverage Options for Small Fleets

Small fleets, whether comprising a handful of trucks or delivery vans, require robust insurance coverage to protect their valuable assets and ensure operational continuity. However, concerns about affordability often arise when it comes to securing suitable fleet insurance. Thankfully, the market offers a range of budget-friendly options tailored specifically for new fleets seeking reliable protection. These affordable policies not only cover liability but also extend to cargo protection, physical damage, and even multi-truck insurance plans, catering to diverse fleet management needs.

For startups or small businesses just entering the trucking industry, accessing low-cost trucking coverage can be a game-changer. By exploring options that offer comprehensive yet cost-effective solutions, fleet operators can mitigate risks associated with physical damage, cargo loss, or liability claims without breaking the bank. This proactive approach to insurance ensures that new fleets can navigate the road ahead with confidence and financial security.

Protecting Your Cargo and Trucks with Comprehensive Insurance Plans

Protecting your cargo and trucks is paramount for any fleet operator, especially when aiming for long-term resilience. Affordability shouldn’t compromise reliability when it comes to insurance. New fleets or established operations, budget-friendly fleet insurance offers comprehensive coverage options tailored to mitigate risks specific to trucking. This includes physical damage insurance, crucial for safeguarding your vehicles from accidents and natural disasters, as well as cargo protection, ensuring your goods reach their destinations intact.

For startup fleets or those looking to expand, low-cost trucking coverage can be a game-changer. Multi-truck insurance plans provide an efficient and cost-effective solution, offering flexibility and customization to meet unique operational needs. By prioritizing these budget-friendly options, fleet managers can maintain reliable operations while fostering financial stability, ultimately contributing to the long-term success and resilience of their businesses.

Navigating Multi-Truck Insurance and Startup Fleet Coverage Options

Navigating the complex world of insurance can be a daunting task, especially for new businesses venturing into trucking or fleet management. One key aspect to ensure long-term resilience is securing suitable coverage options that balance affordability and reliability. For startups, choosing the right budget-friendly fleet insurance is essential to mitigate risks without breaking the bank. Affordable policies for new fleets often include basic liability coverage, which protects against potential claims arising from accidents or damages caused by your vehicles.

When exploring multi-truck insurance plans, businesses should consider their specific needs, including low-cost trucking coverage for cargo protection and physical damage to vehicles. These options cater to small fleets looking to manage liabilities effectively without excessive costs. By carefully evaluating various coverage tiers and exclusions, fleet operators can tailor their startup fleet insurance to suit their operations, ensuring they are protected while maintaining financial flexibility.

Building long-term resilience for fleet operations requires a strategic approach to insurance. By exploring affordable policies for new fleets and budget-friendly options tailored to small fleets, operators can ensure their cargo and trucks are protected. Comprehensive insurance plans offer vital coverage against physical damage, while multi-truck insurance and startup fleet insurance provide flexible solutions. Adopting these strategies enables fleet managers to maintain operational continuity, manage risks effectively, and thrive in a competitive market with cost-efficient trucking coverage.