In today's digital era, understanding common fraud schemes is crucial for protecting assets and financial security. Scammers target victims through various channels, with identity theft being a primary concern. Fraud prevention counseling equips individuals to recognize and avoid scams. Robust identity theft protection, including strong passwords and regular software updates, safeguards personal info. Elderly populations require tailored strategies, such as financial fraud awareness sessions and comprehensive fraud risk assessments, due to increased vulnerability. Personal security consulting offers customized guidance on asset protection and threat response. Businesses should conduct fraud risk assessments, implement access controls, and offer training to prevent elder fraud. Tailored counseling and education empower the elderly to navigate financial landscapes securely.

Protecting your hard-earned assets from cunning fraudsters is a top priority for savvy individuals and businesses alike. With ever-evolving tactics, staying one step ahead demands a multi-layered approach to fraud prevention. This comprehensive guide navigates the complex landscape of financial fraud awareness, offering expert strategies to fortify defenses against common scams and schemes. From understanding identity theft protection measures to implementing cyber fraud prevention, we explore special considerations for the elderly population and provide insights into personal security consulting for a robust fraud risk assessment.

Understanding Common Fraud Schemes and Scams

Understanding Common Fraud Schemes and Scams is a crucial step in protecting your assets and ensuring your financial security. In today’s digital era, cyber fraud prevention has become more complex as scammers leverage technology to target victims through various channels, including email phishing, text messaging, and social media. Identity theft protection is a primary concern, as thieves can use stolen personal information for financial gain, opening fraudulent accounts or making unauthorized transactions. Financial fraud awareness is essential for everyone, but especially for the elderly, who may be more susceptible to elder fraud protection strategies due to their trust in unfamiliar situations or individuals.

Fraud prevention counseling and personal security consulting services offer valuable insights into recognizing and avoiding these scams. A comprehensive fraud risk assessment can help individuals identify potential vulnerabilities and implement tailored strategies for preventing scams and fraud. By staying informed about the latest tactics used by scammers, you can better navigate a complex landscape of threats, ensuring your financial assets and personal information remain secure.

Implementing Effective Identity Theft Protection Measures

Implementing robust identity theft protection is a crucial aspect of comprehensive fraud prevention. It involves proactive measures to safeguard personal and financial information from malicious actors. One effective strategy is utilizing expert fraud prevention counseling, which equips individuals with knowledge on recognizing and avoiding potential scams and frauds. This includes enhancing cyber fraud prevention by employing strong passwords, two-factor authentication, and regularly updating security software to protect against digital breaches.

For at-risk populations like the elderly, tailored elder fraud protection strategies are essential. These strategies often include regular financial fraud awareness sessions and a thorough fraud risk assessment to identify vulnerabilities. Personal security consulting services can also be beneficial, offering customized guidance on protecting assets, understanding potential threats, and responding swiftly in case of any suspicious activities, thereby ensuring comprehensive peace of mind.

Proactive Cyber Fraud Prevention Strategies for Individuals and Businesses

In today’s digital era, proactive cyber fraud prevention is more crucial than ever for both individuals and businesses. With the rise of sophisticated online scams and identity theft, protecting one’s assets requires a multi-layered approach. Expert fraud prevention counseling offers valuable insights into mitigating financial fraud risks. This includes staying vigilant against phishing attempts, regularly reviewing financial statements for any unusual activity, and enabling two-factor authentication for added security.

Personal security consulting and cyber fraud prevention strategies involve regular updates of software and antivirus programs, as well as educating oneself about the latest scams. For businesses, a comprehensive fraud risk assessment is essential to identify vulnerabilities. Implementing strong access controls, conducting thorough background checks on employees, and offering ongoing financial fraud awareness training can significantly reduce the risk of elder fraud and other forms of fraud. Additionally, staying informed about regulatory changes related to identity theft protection ensures that one’s assets remain secure in an ever-evolving digital landscape.

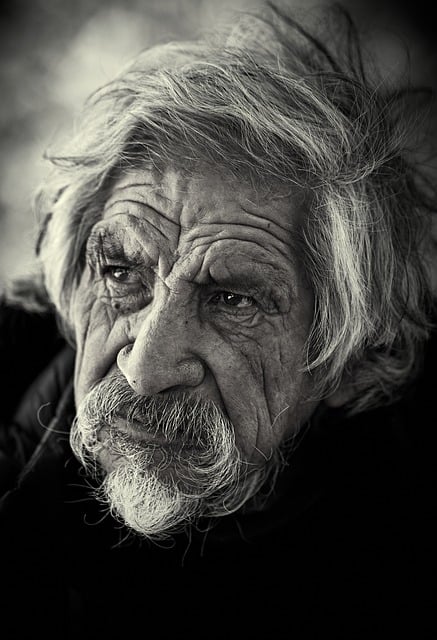

Elderly Population: Special Considerations for Fraud Prevention and Risk Mitigation

The elderly population is particularly vulnerable to various forms of fraud and scams, making fraud prevention counseling and elder fraud protection strategies paramount. As individuals age, they may become more isolated, less mobile, and reliant on others for assistance, which can make them easier targets for con artists. Financial fraud awareness among seniors is critical as their savings and investments can be at risk. Many older adults might struggle with technology, making cyber fraud prevention especially challenging. They may also have a tendency to trust authority figures or people they know slightly, which can lead to the successful execution of scams. Therefore, personalized personal security consulting tailored to their needs is essential for mitigating these risks.

A comprehensive fraud risk assessment should consider factors like cognitive abilities, financial literacy, and living arrangements. Simple measures such as regular identity theft protection through credit monitoring services can be a good starting point. Educating seniors about common scams, teaching them to verify requests for personal information, and encouraging the use of secure communication channels are all part of building a robust defense against fraud. By empowering the elderly with knowledge and tools, they can navigate their financial world with greater confidence and security.

Protecting your assets from fraudulent activities is a multifaceted endeavor. By understanding common fraud schemes, implementing robust identity theft protection measures, and adopting proactive cyber fraud prevention strategies, individuals and businesses can significantly mitigate risks. A comprehensive fraud risk assessment is key to identifying vulnerabilities and tailoring defense mechanisms accordingly. For the elderly population, specialized fraud prevention counseling and awareness programs are essential due to heightened vulnerability. Embrace financial fraud awareness and seek expert advice through personal security consulting for tailored solutions, ensuring peace of mind in an increasingly digital world.