New ventures face significant liability challenges due to limited resources and rapid growth. Startups are vulnerable to product liability, general liability, and trucking-specific risks. Affordable truck insurance and scalable policies, like tailored fleet insurance, are essential for risk mitigation. Startup-friendly insurance quotes offer comprehensive coverage at competitive rates, enabling business owners to focus on growth while protected against financial disasters. As startups expand, they need adaptable insurance that scales with their operations, including low-cost trucking insurance and cargo coverage plans.

Mitigating liabilities is a critical yet often overlooked aspect of building a successful new venture. This comprehensive guide explores how tailored insurance strategies can protect startups from unique liability challenges. We delve into the benefits of startup-friendly insurance quotes, focusing on affordable truck insurance and cargo coverage plans that scale with your business growth. By understanding the key considerations for new business coverage and tailored fleet insurance, entrepreneurs can navigate risks effectively and secure their future.

Understanding the Unique Liability Challenges of New Ventures

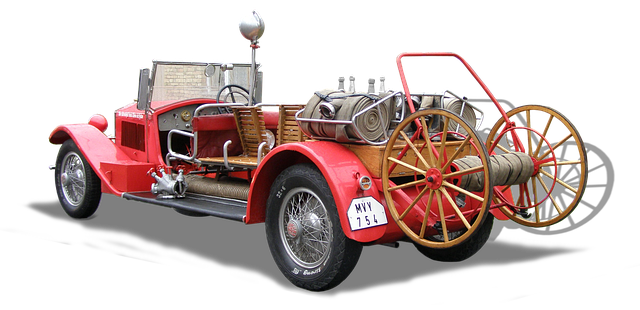

New ventures face a unique set of liability challenges that differ from established businesses. As startups often operate with lean resources and rapid growth, they may be more susceptible to financial strain from unexpected legal claims or accidents. These can range from product liability issues, where a defective item causes harm, to general liability cases stemming from premises damage or personal injury on the startup’s property. Additionally, startups involved in trucking or transportation face extra risks, requiring specific coverage for cargo and fleet operations.

Affordable truck insurance and scalable policies designed for startups are crucial here. Tailored fleet insurance can help protect against losses related to vehicle accidents, cargo damage, and legal responsibility. By securing new business coverage that includes comprehensive liability insurance and appropriate cargo coverage plans, startup owners can mitigate potential financial disasters and focus on building their ventures. Startup-friendly insurance quotes that offer flexible options and competitive rates make it easier for new businesses to secure the protection they need at an affordable cost.

The Benefits of Tailored Insurance for Startups

For startups venturing into the unknown, a well-crafted insurance strategy is essential to navigate risks and uncertainties. Tailored insurance plans designed specifically for new ventures offer numerous advantages, making them an attractive option for entrepreneurs seeking financial protection. One of the key benefits is their ability to provide startup-friendly insurance quotes that are both affordable and comprehensive. These policies cater to the unique needs of emerging businesses, ensuring they receive suitable coverage without breaking the bank.

New business owners can benefit from scalable policies that grow with their operations. Whether it’s acquiring a fleet of trucks or expanding into new markets, tailored fleet insurance allows startups to adapt their coverage accordingly. This flexibility is especially valuable for low-cost trucking insurance, where startups can secure cargo coverage plans that protect their goods and assets during transportation. Additionally, liability insurance for startups becomes more accessible and manageable, offering peace of mind as these businesses take their first steps into the competitive market.

Exploring Affordable Coverage Options for Trucking and Cargo

Starting a trucking or logistics business? Navigating the world of insurance can be a daunting task, especially for new ventures with limited resources. However, exploring affordable coverage options doesn’t have to be a challenge. Many insurance providers offer startup-friendly insurance quotes tailored specifically to the unique needs of growing fleets and cargo operations.

Obtaining scalable policies that align with your business’s growth trajectory is essential. This means finding low-cost trucking insurance that provides comprehensive liability insurance for startups, including protection against potential cargo damage or loss. With careful consideration and a dedicated search for new business coverage, entrepreneurs can secure suitable cargo coverage plans at competitive rates.

Building Scalable Policies to Support Startup Growth

As startups grow and expand their operations, their insurance needs evolve as well. Scalable policies are essential to ensure that new businesses can navigate risks effectively throughout their journey. Startup-friendly insurance quotes often offer flexible coverage options tailored to meet the unique demands of each stage of growth. For instance, affordable truck insurance designed for startups can provide comprehensive protection for growing fleets, including specialized cargo coverage plans. These policies allow young companies to scale their liability insurance without breaking the bank, addressing both vehicles and valuable cargo.

This adaptability is particularly crucial when considering the diverse fleet operations common in many startups. Tailored fleet insurance allows new businesses to customize their coverage based on specific vehicle types, use cases, and risk profiles. By offering scalable policies, insurers enable startups to manage liability risks efficiently, ensuring they have the right amount of protection as their business grows and their fleets expand. This proactive approach to insurance not only mitigates potential financial losses but also fosters a culture of responsible growth in new ventures.

For new ventures navigating the complexities of their first steps, securing appropriate liability insurance is key to mitigating risks and fostering sustainable growth. By understanding the unique challenges they face, startups can leverage tailored insurance solutions like affordable truck insurance and scalable policies designed specifically for their needs. Accessing startup-friendly insurance quotes allows them to protect their assets, manage liabilities effectively, and focus on what matters most: building a successful business.