As businesses in transportation and fleet management grow, their risk management needs evolve. Collision insurance and comprehensive truck protection are crucial to mitigate risks for owner-operators and independent truckers, covering unexpected costs from vehicle damage or collisions. Tailored physical damage policies provide repair and replacement coverage, offering peace of mind and enabling business focus on growth. These strategies ensure vehicles remain operational during unforeseen events, balancing safety with expansion.

As your trucking operations grow, so does the need for scalable coverage. Understanding and prioritizing certain types of insurance is crucial to navigate expanding risks. This article guides you through essential aspects of physical damage coverage for owner-operators, collision insurance for independent truckers, and how to tailor comprehensive truck protection to fit your unique business needs. Discover affordable vehicle damage insurance options and repair and replacement coverages that ensure peace of mind on the road.

Understanding the Need for Scalable Coverage as Operations Expand

As businesses grow, their operational needs evolve, particularly when it comes to transportation and fleet management. This expansion requires a corresponding increase in insurance coverage to mitigate risks effectively. Owner-operators and independent truckers, for instance, face unique challenges on the road, including potential collisions and physical damage to vehicles. Traditional insurance policies may not always provide comprehensive protection tailored to these specific needs, especially as their operations scale. Thus, understanding the necessity of scalable coverage is pivotal.

Collision insurance for independent truckers and comprehensive truck protection are essential components of a robust risk management strategy. Affordable vehicle damage insurance that offers repair and replacement coverage ensures that owners are not burdened with unexpected costs. Tailored physical damage policies cater to the specific requirements of these businesses, offering peace of mind as they navigate the ever-changing landscape of transportation and fleet operations.

Physical Damage Coverage Owner-Operators Shouldn't Overlook

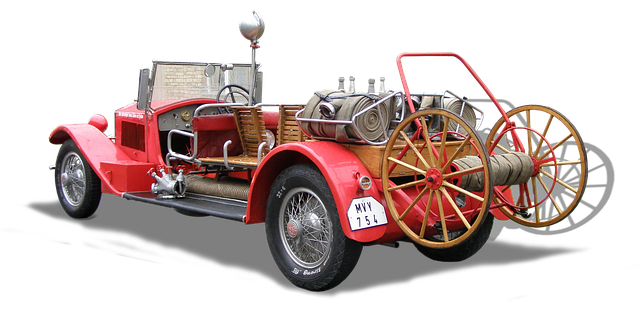

As an owner-operator, navigating the complex landscape of insurance options can be challenging, especially when it comes to protecting your most valuable asset—your truck. While many focus on comprehensive coverage, one area often overlooked is physical damage coverage. This type of insurance provides crucial protection against unexpected events that can leave your vehicle damaged or even totaled. For independent truckers, collision insurance is a vital component of their risk management strategy.

Tailored physical damage policies offer repair and replacement coverage for various types of incidents, from minor fender benders to more severe collisions. An affordable vehicle damage insurance plan can provide peace of mind, ensuring that repairs are covered efficiently without breaking the bank. This proactive approach allows owner-operators to focus on their core business while knowing their investment is secured, ultimately contributing to a smoother and more sustainable operation as they grow.

Collision Insurance for Independent Truckers: Protecting Your Investment

As an independent trucker, your operation’s growth means expanding your fleet and increasing on-the-road time—all while navigating ever-changing regulations and safety standards. In this dynamic environment, ensuring comprehensive protection for your vehicles is non-negotiable. Beyond basic liability insurance, collision insurance for independent truckers provides crucial physical damage coverage owner-operators need to safeguard their investment. This tailored physical damage policy goes beyond minimal requirements, offering repair and replacement coverage that can help you get back on the road faster after accidents or other incidents.

Choosing the right collision insurance means finding a balance between comprehensive truck protection and affordable vehicle damage insurance. With access to specialized policies designed for the unique needs of owner-operators, you can protect your business from unexpected events without breaking the bank. By prioritizing this type of coverage, independent truckers can focus on growing their operations with confidence, knowing their vehicles are shielded against potential physical damage.

Tailoring Comprehensive Truck Protection to Fit Your Business Needs

As your trucking business expands, it’s crucial to adapt your insurance strategies to match. One key area is comprehensive truck protection—a customizable package designed to safeguard against a wide range of risks unique to the road. Owner-operators and independent truckers can benefit from tailored physical damage policies that go beyond collision insurance for their vehicles. This includes coverage for not just accidents, but also theft, natural disasters, and even vandalism.

By choosing a comprehensive truck protection plan, you gain access to repair and replacement coverage options that ensure your fleet remains operational during unexpected events. These policies are affordable and flexible, allowing business owners to select the level of protection needed based on their specific operations. This personalized approach ensures that regardless of the challenges thrown by a growing business, your trucks remain protected, keeping your operations running smoothly.

As your trucking operations expand, prioritizing scalable coverage is key. Balancing physical damage coverage, collision insurance, and comprehensive truck protection ensures you’re prepared for any growth-related challenges. By tailoring these policies to fit your specific business needs, you can access affordable vehicle damage insurance that includes repair and replacement coverage, offering peace of mind in today’s dynamic trucking landscape.