Single-owner businesses in the transportation sector, particularly those in trucking, must secure tailored insurance to manage risks effectively. Tailored insurance for independent operators, including affordable business insurance with comprehensive liability coverage, is essential to protect against financial losses from accidents and lawsuits. Customized trucking insurance packages offer critical cargo protection, ensuring losses due to theft, damage, or loss of goods are covered. Physical damage policies provide protection for repairing or replacing trucks after accidents or non-collision events like fires or vandalism, designed to be flexible and cater to the unique needs and budgetary constraints of small business owners in the trucking industry. This insurance ensures peace of mind and operational confidence by covering various risks faced by solo operators, with a focus on both protective measures and financial prudence. Obtaining the right combination of coverage for single-owner businesses is crucial for maintaining financial stability and ensuring continued operations amidst the diverse challenges in cargo transportation.

When venturing into the realm of commercial transportation, safeguarding your business against unforeseen events is paramount. This article delves into the critical aspects of coverage tailored for single-owner businesses, emphasizing liability and cargo insurance as well as physical damage policies that offer robust protection. We explore how tailored insurance strategies can be both cost-effective and comprehensive for independent operators, ensuring your assets remain secure amidst the dynamic trucking industry. Whether you’re a solo entrepreneur or managing a small fleet, understanding your coverage options is key to maintaining operational continuity and financial stability.

Navigating Liability and Protection: Coverage Essentials for Single-Owner Businesses

In the realm of single-owner businesses, particularly those involved in transportation like trucking, having tailored insurance is a cornerstone of financial security. Coverage for single-owner businesses must be comprehensive to protect against unforeseen events. Affordable business insurance that offers liability coverage for small businesses ensures protection against claims and lawsuits arising from accidents or injuries caused by the business’s operations. This is crucial when considering the potential costs associated with third-party damages or legal liabilities, which can be substantial.

For independent operators who handle cargo, cargo protection is an indispensable aspect of their insurance portfolio. Customized trucking insurance packages often include cargo coverage that addresses loss, theft, or damage to goods in transit. This safeguard is essential for solo operators whose businesses may otherwise face significant financial repercussions should their cargo be compromised. Additionally, physical damage policies are designed to cover the cost of repairing or replacing a truck if it’s involved in an accident or suffers from a non-collision incident like fire or vandalism. These insurance options can be tailored to fit the specific needs and budgetary constraints of single-owner businesses, offering peace of mind and allowing these entrepreneurs to operate with confidence.

Tailored Insurance Strategies: Affordable Solutions for Independent Operators

For independent operators, navigating the complex landscape of insurance can be daunting. Single-owner businesses require coverage that is both comprehensive and cost-effective, ensuring peace of mind on the road. Tailored insurance strategies for these operators are not just a checklist of boxes to tick; they’re a critical component of their business plan. Customized trucking insurance packages provide the necessary protection, encompassing liability, cargo, and physical damage policies that cater to the unique needs of solo entrepreneurs. These solutions are designed to be affordable business insurance options, offering the right balance between coverage and cost. By opting for specialized insurance products, these operators can secure their operations against potential financial losses due to accidents, cargo claims, or third-party liabilities, which are all too common in the transportation industry. The key is finding a policy that aligns with the specific risks of the business, ensuring that coverage doesn’t fall short when it’s most needed. Operators should work closely with experienced insurance providers who understand the nuances of cargo protection for solo operators and can offer tailored solutions that are both protective and financially sensible.

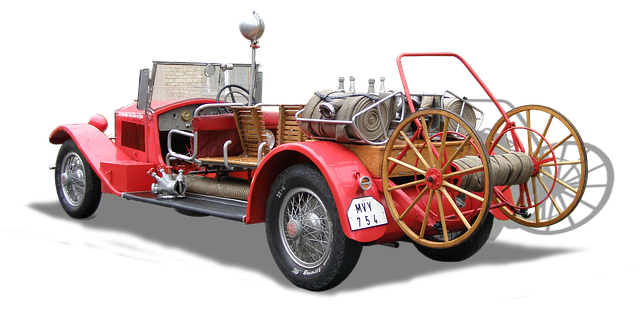

Customized Trucking Insurance Options: Cargo Protection Plans for Solo Entrepreneurs

For solo entrepreneurs in the trucking sector, securing coverage that aligns with their unique operations is paramount. Customized trucking insurance options cater specifically to the needs of single-owner businesses, offering tailored insurance for independent operators. These policies are designed to provide affordable business insurance solutions that encompass liability coverage for small businesses, ensuring financial protection against potential claims or lawsuits arising from accidents involving your truck and cargo. Moreover, physical damage policies within these packages safeguard your vehicle against collisions, theft, or other unforeseen events, maintaining your operational capacity without significant interruptions.

In the realm of cargo protection for solo operators, it’s essential to consider the vulnerabilities inherent in transporting goods. Customized trucking insurance can extend to include comprehensive coverage for lost, stolen, or damaged cargo, recognizing that such assets are the lifeblood of your business. This ensures that even when faced with such incidents, your financial standing remains intact, and your business can continue to operate with minimal disruption. Furthermore, these tailored policies often include additional benefits, such as coverage for freight contamination or spoilage, offering a robust shield against the myriad risks associated with cargo transportation.

Physical Damage Policies: Comprehensive Coverage for Your Fleet's Safety

For single-owner businesses in the trucking sector, securing a comprehensive physical damage policy is paramount to safeguard their fleet’s integrity and operational continuity. These tailored insurance solutions are specifically designed for independent operators, offering them the peace of mind that their vehicles are protected against non-collision perils such as theft, vandalism, or natural disasters. Affordable business insurance options are available, ensuring that even with budget constraints, essential coverage is accessible.

Moreover, cargo protection plans for solo operators are an integral component of these policies, providing a robust shield against loss or damage to the goods being transported. This critical aspect of the insurance package is crafted to meet the unique needs of small businesses in the logistics and transportation industry, ensuring that their financial stability isn’t jeopardized by unforeseen events impacting their cargo. With customized trucking insurance options becoming increasingly sophisticated and affordable, it’s an opportune time for operators to review their coverage and enhance their liability protections accordingly.

In conclusion, small business owners and independent operators in the transportation sector must carefully assess their coverage needs to safeguard their operations against unforeseen events. Single-owner businesses can benefit from tailored insurance strategies that offer comprehensive liability coverage at an affordable rate. Customized trucking insurance packages with robust cargo protection plans are indispensable for solo entrepreneurs, ensuring peace of mind on the road. Equally crucial is securing physical damage policies to protect your fleet, which are vital components in maintaining a resilient business. By understanding and implementing coverage options designed specifically for small businesses, operators can fortify their financial stability and mitigate potential risks, paving the way for sustained success and growth in the dynamic realm of transportation.