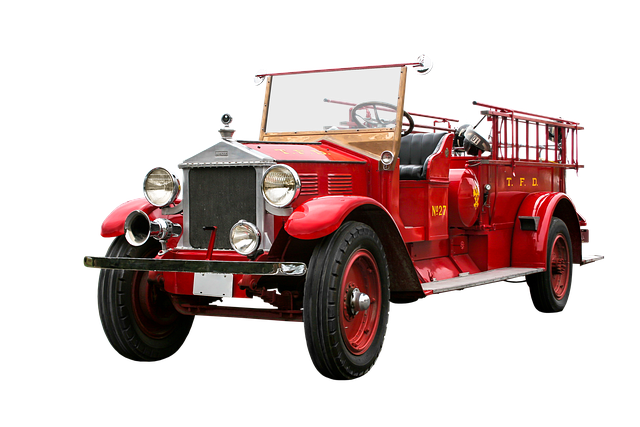

Starting a trucking business demands strategic risk management through tailored insurance plans to protect against financial losses and build a solid reputation. New trucking businesses should prioritize comprehensive trucking insurance with liability coverage, physical damage insurance, and cargo insurance based on specific needs like vehicle types, cargo, and driving distances. Obtaining affordable trucking policies designed for startups offers peace of mind while managing operational costs, demonstrating responsible risk management in a competitive industry where startup fleet coverage is vital.

Launching a new trucking business comes with significant risks. Protecting your reputation and ensuring financial stability requires robust claims management strategies and the right insurance coverage. This article guides new trucking businesses through understanding their risks, tailoring insurance plans for optimal startup fleet coverage, implementing best practices for managing claims, and securing essential physical damage insurance and liability coverage to safeguard both your assets and your future. Discover how to achieve the best coverage for your new trucking business while maintaining affordable trucking policies.

Understanding Your Risks: A Comprehensive Guide for New Trucking Businesses

Starting a new trucking business comes with its own set of challenges and risks that can impact your reputation if not managed properly. Understanding and mitigating these risks through robust claims management strategies is crucial for any startup fleet. The first step is to assess your specific needs and identify potential hazards unique to the trucking industry. This includes evaluating the type of cargo carried, routes traveled, and vehicle types within your fleet.

Obtaining comprehensive trucking insurance that suits your startup’s requirements is essential. Look for tailored insurance plans offering a combination of liability coverage, physical damage insurance, and cargo insurance. The best coverage for new trucking businesses often includes startup fleet coverage, ensuring you’re protected against financial losses due to accidents, theft, or damages to your vehicles and cargo. Affordable trucking policies designed specifically for startups can provide peace of mind while keeping operational costs manageable.

Tailoring Insurance Plans: How to Choose the Right Coverage for Your Startup Fleet

When starting a trucking business, one of the most critical steps in protecting your reputation and ensuring smooth operations is selecting the right insurance coverage. New trucking businesses should focus on tailored insurance plans that offer the best balance between comprehensive trucking insurance and affordable policies. This involves assessing specific risks associated with your fleet, such as vehicle types, cargo being transported, and driving distances.

Choosing the right startup fleet coverage means understanding what liability coverage and physical damage insurance are essential for your operation. For instance, cargo insurance is crucial to protect against losses due to damaged or missing goods. By carefully evaluating these needs, you can create a tailored insurance plan that provides comprehensive protection for your new trucking business while keeping costs manageable.

Best Practices for Managing Claims: Ensuring Affordable Trucking Policies and Peace of Mind

When starting a new trucking business, navigating the complexities of claims management is essential for building a solid reputation and securing peace of mind. One of the best practices is to obtain best coverage through tailored insurance plans that cater to the unique needs of your fleet. This involves assessing factors like driver experience, vehicle type, and operational scope to ensure you have adequate comprehensive trucking insurance. For cargo insurance startups, focusing on key areas such as liability coverage for new fleets and physical damage insurance can help mitigate risks significantly.

By prioritizing affordable trucking policies, new businesses can avoid financial strain during claim settlements, ensuring they remain operationally viable. This strategic approach not only protects against potential losses but also demonstrates a commitment to responsible risk management, enhancing the business’s reputation in an industry where startup fleet coverage is paramount.

Protecting Your Cargo: Essential Physical Damage Insurance and Liability Coverage for New Fleets

Starting a trucking business can be an exciting yet daunting endeavor. One of the most critical aspects to ensure smooth sailing is securing robust insurance coverage, especially tailored for new fleets. With significant investments in vehicles and cargo, protecting your assets from potential physical damage and liabilities is paramount. Comprehensive trucking insurance packages offer startup fleet owners the best coverage to safeguard against unforeseen events.

Physical Damage Insurance plays a pivotal role in shielding your cargo and trucks from perils like accidents, natural disasters, and theft. Liability Coverage ensures that your business is protected financially if your vehicle causes property damage or personal injury to others during transit. Tailored insurance plans specifically designed for new trucking businesses offer affordable policies that cover both physical damage and liability, providing comprehensive startup fleet coverage.

For new trucking businesses, navigating the complex landscape of claims management and insurance is a crucial step towards ensuring long-term success. By understanding your risks, tailoring insurance plans to fit your startup fleet’s unique needs, and implementing best practices for managing claims, you can achieve the best coverage available. This includes essential physical damage insurance and liability coverage for cargo insurance startups, ultimately providing peace of mind and affordable trucking policies that protect both your assets and reputation.