Box truck insurance is crucial for delivery service providers, offering liability and comprehensive protection against risks. Custom policies tailored to fleet size, driver experience, cargo value, and operational locations determine rates. Lowering insurance costs involves strategic steps like bundling, clean driving records, evaluating business needs, and regularly comparing quotes from insurers. Key terms: box truck insurance, delivery truck insurance, box truck liability coverage, custom box truck insurance, box truck protection, box truck business insurance, insurance for box trucks, commercial box truck insurance.

“In the fast-paced world of delivery and logistics, securing competitive box truck insurance rates is a vital step for any business owner. This comprehensive guide will navigate you through the intricacies of box truck insurance, from understanding basic coverage options like liability to custom policies tailored to your unique business needs. By exploring factors influencing rates and implementing cost-saving tips, you can ensure adequate protection for your valuable box trucks while keeping expenses manageable in the competitive market.”

- Understanding Box Truck Insurance Basics: Types and Coverage Options

- Factors Affecting Competitive Box Truck Insurance Rates

- Customizing Your Policy: Tailoring Protection for Your Business

- Tips to Lower Your Delivery Truck Insurance Costs

Understanding Box Truck Insurance Basics: Types and Coverage Options

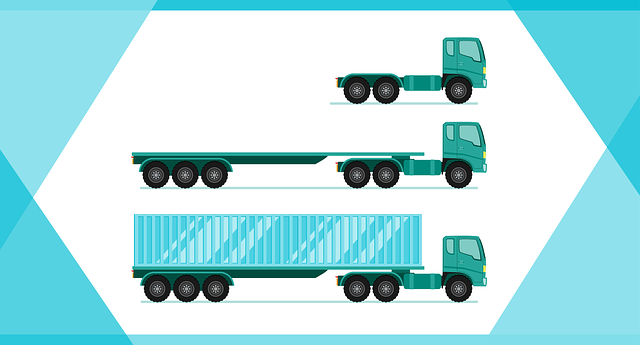

Box truck insurance is a crucial aspect for owners and operators involved in delivery services, ensuring comprehensive protection against potential risks and financial losses. When it comes to understanding box truck insurance, one must be aware of its various types and coverage options tailored to meet specific business needs. The primary goal of any policy is to safeguard against liabilities arising from accidents, damages, or legal issues related to the operation of a box truck.

There are different types of box truck policies available, including liability coverage that protects against claims for injuries or property damage caused during operations. Additionally, comprehensive insurance options cater to unforeseen events like theft, vandalism, or natural disasters. Custom box truck insurance is also an attractive choice for businesses with specialized requirements, offering tailored protection for unique cargo, vehicles, and operations. These policies ensure that owners and drivers are not only compliant but also adequately protected in the dynamic landscape of delivery truck services.

Factors Affecting Competitive Box Truck Insurance Rates

The competitive landscape of box truck insurance rates is shaped by several key factors. One of the primary considerations for insurers is the specific nature of the box truck business, including its operations and risk profile. Delivery trucks, in particular, face unique challenges due to their frequent stops, urban environments, and potential exposure to cargo damage or theft. Insurers assess these risks through detailed policy questionnaires and driving history checks to determine appropriate coverage levels.

Custom box truck insurance policies cater to the distinct needs of this sector, offering tailored protection for specialized equipment and operations. Factors such as fleet size, driver experience, safety record, and the type and value of cargo carried all influence premium calculations. Furthermore, locations where the trucks operate significantly impact rates, with urban areas often presenting higher risks due to congestion and potential accidents. Understanding these dynamics is crucial for business owners looking to secure competitive box truck liability coverage and comprehensive protection for their operations.

Customizing Your Policy: Tailoring Protection for Your Business

When it comes to box truck insurance, one size does not fit all. As a business owner operating delivery trucks, customizing your policy is essential to ensuring adequate delivery truck insurance protection for your unique needs. This means going beyond the basic coverage and exploring options that align with your specific risk profile and operational requirements.

Consider elements such as the value of your fleet, the types of cargo you transport, and the territories in which you operate. Some policies offer enhanced box truck liability coverage for high-risk scenarios or specialized goods. Customizing your box truck policy allows you to secure the box truck protection necessary to safeguard your business from potential losses, ensuring peace of mind on the road.

Tips to Lower Your Delivery Truck Insurance Costs

Lowering your delivery truck insurance costs can be achieved through a few strategic steps. First, consider bundling multiple types of insurance policies under one provider. Many insurance companies offer discounts when you combine auto, liability, and commercial coverage, as it simplifies their processes and reduces risk. Second, maintain a clean driving record and claim-free history. Insurance providers often reward safe drivers with lower premiums, so practicing defensive driving techniques can save you money in the long run.

Additionally, evaluating your specific business needs is crucial. If your box truck operates within a limited geographical area or carries specialized non-perishable goods, you might qualify for reduced rates. Customizing your box truck insurance policy to match your unique operations and risks can help lower costs without compromising protection. Regularly reviewing and comparing quotes from various insurers also ensures you secure the best value for your dollar in terms of insurance for box trucks, commercial or custom.

When navigating the world of box truck insurance, understanding the various factors influencing rates and customizing your policy to fit your unique business needs is key. By exploring different coverage options, considering risk management strategies, and shopping around for the best quotes, you can secure competitive box truck liability coverage without breaking the bank. Remember, a well-tailored delivery truck insurance policy provides peace of mind and ensures your business remains protected against potential risks on the road.